Working Paper

Model Risk Under CECL: A Consumer Finance Perspective

WP 26-09 – The author examines the challenges of economic forecasting and model misspecification errors confronted by financial institutions implementing the novel current expected credit loss (CECL) allowance methodology and its impact on model risk and bias in CECL projections.

Featured Work

Working Paper

Credit Scores and Inequality across the Life Cycle

WP 26-07 – Among a cohort born in the same year, inequality in consumption, income, and credit scores (reputational inequality) rises with age. Models of reputation formation are presented to explain these patterns. Information bans are studied.

Working Paper

Explaining Contract Heterogeneity in the Credit Card Market

WP 26-03 – Administrative data are used to establish facts on terms, usage, and default rate of credit card accounts. A credit card model is developed to explain the facts. The model explains high MPCs and implies the rate caps are welfare-reducing.

Working Paper

Consumer Credit with Over-Optimistic Borrowers

WP 21-42/R – Do cognitive biases call for regulation to limit the use of credit? We incorporate over-optimistic and rational borrowers into an incomplete markets model with consumer bankruptcy.

Featured Data

CFI COVID-19 Survey of Consumers

To gain insights into the impact of the COVID-19 pandemic on financial security in the U.S., the Consumer Finance Institute at the Federal Reserve Bank of Philadelphia conducted a series of national surveys of consumers beginning in April 2020 and concluding in April 2022.

Updated: 30 May ’23

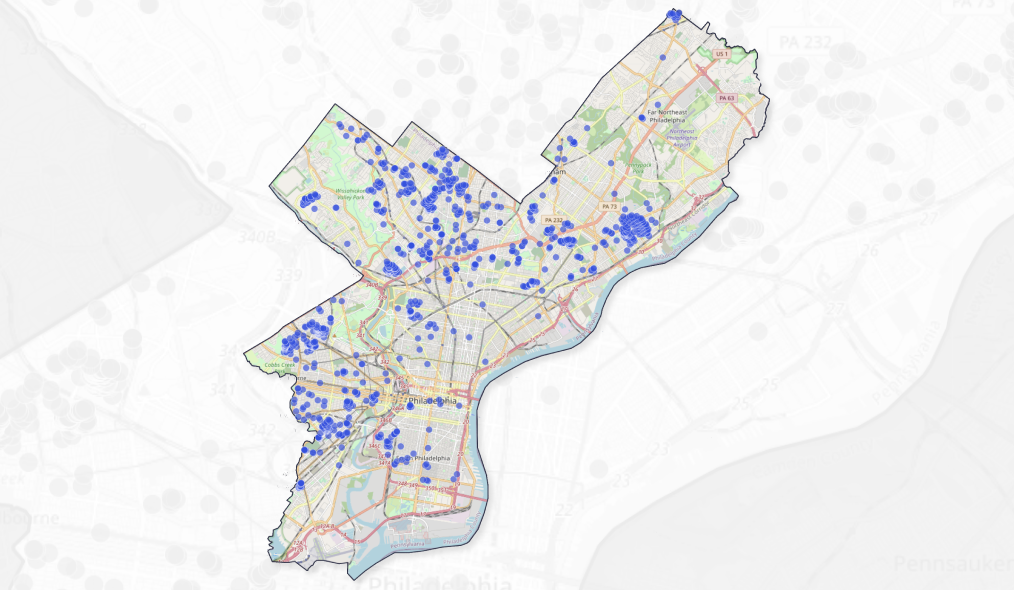

Philadelphia’s History of Racially Restricted Housing

As part of the Philadelphia Fed’s efforts to understand how housing affects the economy in our District, our researchers are studying the links between past housing discrimination and present-day outcomes.

Updated: 20 Feb ’24