Research Fellow, Consumer Finance

Institute

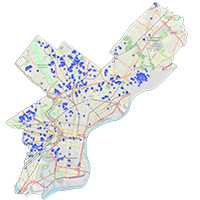

Access to homeownership and quality housing is vital to a strong U.S. economy. As part of our efforts to examine historical barriers to housing and their lasting effects, the Philadelphia Fed released an interactive map of the city of Philadelphia that explores the use of racial covenants: language added to deeds that prevented non-White individuals from buying or renting property. The map shows where nearly 4,000 properties with deeds that included racial covenants were located. These properties formed an invisible barrier to newly developed areas and around predominantly White neighborhoods.

We spoke with Larry Santucci, advisor and research fellow in our Consumer Finance Institute (CFI), the researcher behind this project, and asked him how he became interested in racial covenants and how they relate to the mission of CFI and the Fed.

Q: How did you first get the idea to develop this map of racial covenants in the city of Philadelphia?

LS: I listened to a radio interview with Richard Rothstein, who wrote a book called The Color of Law: A Forgotten History of How Our Government Segregated America. He was talking about segregation in housing and how the Federal Housing Administration (FHA) continued to use racial covenants as a precondition for mortgage insurance long after the Supreme Court ruled they were unenforceable in 1948. I wondered if racial covenants had been used here in Philadelphia and whether we could find them in the historical deed books.

A few years prior to hearing this interview, I had looked at the average credit score — a measure of creditworthiness — by census tract in Philadelphia and noticed that the tracts with low average credit scores also tended to have majority-Black populations and be historically underserved. After hearing the Rothstein interview, I began to think about the links between present-day financial outcomes and historic forms of housing discrimination such as racial covenants.

I contacted the City of Philadelphia Department of Records. They were able to get us data for the 1920s and 1930s. By searching thousands of records for word fragments, we were able to find about 4,000 racial covenants over a roughly 12-year period.

Q: How would you connect this work to the larger mission of CFI and the Fed?

LS: Wealth, income, and access to financial products are interrelated. We know that homeownership is a primary contributor to wealth building. For many families, their home is their only source of wealth. If you prevent certain groups of people from fully accessing the housing market, you effectively limit the returns they can earn on their investment. That affects people’s residential mobility, their ability to send their children to college, their financial security in retirement, and their bequests to their children. Researchers have documented that education and location affect future income and employment opportunities. This, in turn, suggests that discriminatory housing policies likely have an intergenerational spillover effect.

Although racial covenants are a thing of the past, researchers have linked historical housing discrimination to wealth accumulation and the racial wealth gap we see today. Access to credit, jobs, wealth building, and economic opportunity are all things that fall under the Fed’s mission to ensure financially healthy communities and the overall health of the economy.

Q: When you analyzed the data on racial covenants, what did you find and was there anything that surprised you about it?

LS: I wasn’t surprised that we found so many racial covenants, but their location was interesting. We didn’t see a lot in areas of the city where the housing stock was older, such as along the Delaware waterfront, where White residents may have been happy to vacate. We also didn’t find a lot in Northeast Philadelphia because the area was largely undeveloped. But we did find racial covenants bordering White and non-White neighborhoods and cordoning off the up-and-coming, more suburban areas in the Northeast, Northwest, and Southwest sections of Philadelphia.

map of racial covenants

in Philadelphia.

One surprising thing we noticed is that some neighborhoods that were heavily covenanted back in the ’20s and ’30s are now majority-Black areas. This doesn’t mean that the covenants did not have their intended effect [of reserving certain areas of the city for Whites]. That was most certainly the case over the first several decades. But covenants eventually became unenforceable in courts, and even before that were often broken by Whites willing to sell or rent to Blacks, often at inflated prices. So over a longer time period, a variety of factors [like court decisions, federal legislation, migration patterns, and White flight] all worked to create the city we know today, which by one measure is the 11th most racially segregated city in the nation. But the initial conditions were significantly influenced by the racial covenants and other policies that violated Black citizens’ rights under the equal protection clause of the Fourteenth Amendment.

Q: If racial covenants were invalidated in the 1940s, why are they important today?

LS: For one, sometimes practices continue even after they’re made illegal; they just take on a different form. In this case, even though the U.S. Supreme Court said that racial covenants were unenforceable in 1948, their existence in a deed could still send a clear signal to real estate agents and prospective home buyers. You also see very similar language starting to appear in neighborhood and homeowner association agreements around that time. On top of that, there’s evidence that housing discrimination, in the form of steering minority racial and ethnic groups away from White neighborhoods, still occurs today.

So the story of racial covenants really doesn’t just end one sunny day in 1948. All around the country, the effects of discriminatory housing practices are visible today. A recent study of the Minneapolis area found that racial covenants affected present-day home prices and neighborhood racial composition.

Researchers also think historical housing discrimination played a key role in creating or perpetuating the racial

wealth gap, arguably the best barometer of disparities in financial health. Today the gap stands at about 6 to 1,

meaning that for every $60,000 of wealth held by a White household on average, a Black household has just $10,000.

Although we can’t draw a direct line from covenants to the racial wealth gap, the cumulative effect of

historical housing discrimination has certainly contributed to this disparity.

Q: What are the next steps for this research?

LS: We plan to enhance the data visualization by overlaying historic and present-day racial concentrations by neighborhood. We are also expanding the research to 1910, or as far back as we can go without having to analyze handwritten records, and up until 1965. We believe we will find additional covenanted properties that did not come up in our original search, which will provide further insights.

In addition, with my colleague Dan Moulton in CFI, we will look into the connection between racial covenants and residential segregation patterns, home prices, rental and homeownership own rates, and home equity accumulation and intergenerational wealth transfers.

- The views expressed here are those of Larry Santucci and do not necessarily

reflect those of anyone else at the Federal Reserve Bank of Philadelphia or the Federal Reserve System.

Some portions of this interview have been edited for space.