This product relies on data from federal statistical agencies that were unavailable because of the federal government shutdown. Therefore, updates to this product may be either delayed or canceled. Determinations about future release dates will be made on a day-to-day basis and reflected on the economic release calendar.

Aruoba Term Structure of Inflation Expectations

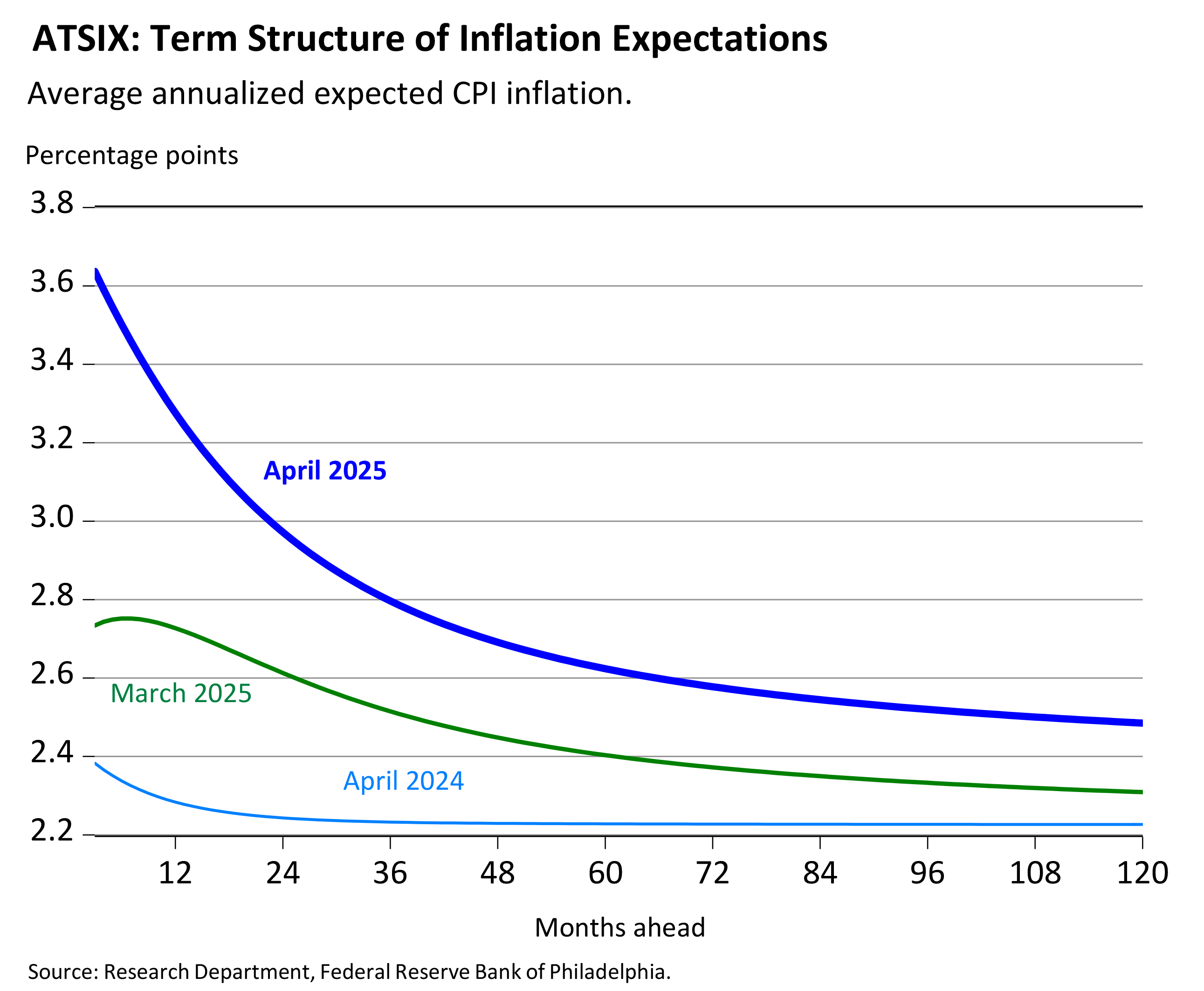

The Aruoba Term Structure of Inflation Expectations (ATSIX) is a smooth, continuous curve of inflation expectations three to 120 months ahead, analogous to a yield curve. A term structure of real interest rates is then obtained from the difference between the nominal yield for a particular horizon and ATSIX inflation expectations over the same horizon. Note that this method leaves an inflation risk premium inside the estimates for the real interest rates.

Uses of the ATSIX

Inflation expectations are commonly gauged in two ways — from expected inflation rates implied in market interest rates and from surveys of economists or consumers. Though all measures of expected inflation are imperfect, measures of expected inflation based on surveys of economists have been found to be generally superior to market-based measures. However, because surveys ask respondents to forecast inflation rates for noncontiguous time horizons, the resulting data points are widely spaced. The ATSIX is useful to policymakers and researchers for studying how inflation expectations and real interest rates evolve and respond to monetary policy and the effect of policy on the term structure of real interest rates, a key transmission mechanism of policy. It is also useful to market participants for pricing securities whose returns are linked to inflation expectations at arbitrary horizons.

ATSIX Details

The ATSIX is created by using a factor model to optimally combine major surveys — the Survey of Professional Forecasters published by the Federal Reserve Bank of Philadelphia and the Blue Chip Economic Indicators and Blue Chip Financial Forecasts published by Wolters Kluwer Law & Business — using a methodology in Aruoba (2016). A forward inflation forecast can also be computed from the formulas in the technical note and the latest factor estimates in the spreadsheet. The ATSIX is updated around the 20th of the month after the source data are released.

On October 21, 2016, modifications were made to the factor model that is used to estimate the term structures for inflation expectations. As noted in the Technical Note (below), the modified model yields new data over the entire historical period.

- Plot of Term Structure of Inflation Expectations (current month, previous month, and same month of previous year)

- Plot of Term Structure of Real Interest Rates (current month, previous month, and same month of previous year)

- Historical Values

- Technical Note

The ATSIX methodology was developed from research initially funded by the Federal Reserve Bank of Minneapolis.

Resource

Aruoba, S. Borağan “Term Structures of Inflation Expectations and Real Interest Rates,” Federal Reserve Bank of Philadelphia Working Paper 16-09/R (September 2016).

Questions

For additional information about this index, e-mail Tom Stark.

View a complete list of upcoming release dates on the Economic Release Calendar.