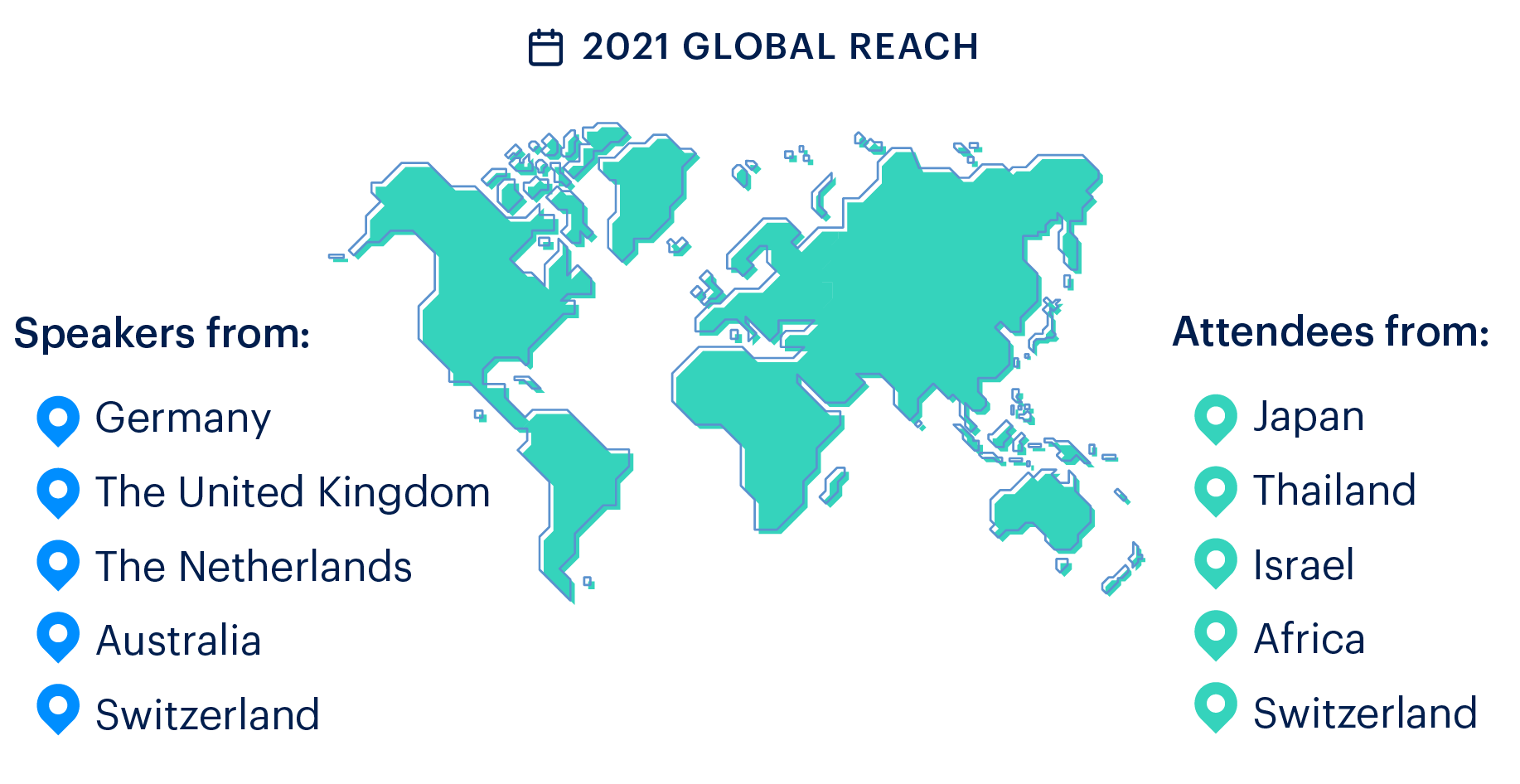

Pre-Event: Expanded Reach

While in-person events certainly have their positive aspects, one of the most significant and tangible benefits of virtual events is the expanded reach. With barriers like travel out of the equation, virtual events broadened who connected and engaged with our events, from speakers to attendees.

programming and registration numbers, while

collecting key feedback through polls and surveys.

“We have finite resources — time, energy, budget — and the shift to hold all events virtually allowed us to allocate resources in innovative ways,” explained Karen Kleskie, manager, Meeting Services, whose team helps our experts navigate all event-related details and logistics from start to finish. “One way this came to life was with finding speakers. Without having to juggle availability, travel arrangements, and other limitations, the Bank expanded our slate of potential speakers. In several cases, events featured speakers that we might not have been able to confirm when travel and other elements were barriers.”

The Bank didn’t just expand our pool of speakers and panelists — virtual events allowed us to further our reach to potential attendees. Whether it was international experts joining from across oceans or Fed System colleagues joining our conferences for the first time, virtual convenings meant new and different audiences were able to join our signature events, many of which drew record attendance in 2021.

Julapa Jagtiani, a senior economic advisor and economist at the Philadelphia Fed, saw this firsthand as she planned the 2021 Fintech Conference. The conference provides financial technology, or fintech, experts with a platform to discuss emerging issues around financial technology, its impact, and policy responses.

“We had attendees from Israel, Thailand, Japan, many of whom were interested in specific sessions or discussions,” Jagtiani explained. “When events were held in person, attendees may not have come all the way to the U.S. just for those targeted discussions. But with virtual events, people who otherwise wouldn’t have made the trip are able to drop into the sessions that are aligned with their interests and expertise without having to juggle travel logistics.” With easier access to the conference, registration soared to more than 1,000 attendees, a fivefold increase from 200 in previous years when it was held in person.

Mid-Event: Audience Engagement

Beyond attracting new audiences, virtual events also provided new avenues to engage participants. One significant trend was using polling features during the event.

incorporate online tools to engage

attendees.

“Virtual events can sometimes feel ‘flat,’ especially without the two-way discussion and networking that makes in-person convenings more engaging and dynamic,” explained Kleskie. “We saw an increased use of tools like polls and surveys to engage our audiences with what our experts were saying, gauge their interest, and evaluate their buy-in.”

This also proved true for Jagtiani’s Fintech Conference. Although in previous years, the conference was streamed for long-distance participants, streaming didn’t allow compelling engagement for those tuning in from afar. But Jagtiani experienced that virtual events, with chat functions and interactive Q&As, proved more dynamic for audiences, especially compared to passively watching a stream or recorded video.

“We used virtual touchpoints to confirm what the audience found valuable,” Kleskie continued, saying one of the most useful tools was question-and-answer sessions at the end of the events. “Seeing the trends and themes of the questions really reinforced and validated where audiences’ interests lay and where there were gaps in understanding, and highlighted opportunities for future topics.”

Post-Event: Learning and Evolving

Audience engagement tools did more than provide real-time feedback and engagement opportunities. The Philadelphia Fed team was able to assess the trends from the chat discussions, Q&A sections, and survey feedback to determine the value of what was presented and identify key best practices to weave into future events.

“In many ways, we were learning as we went,” Kleskie said. “So, we really had to observe what went well, and how and when people engaged to make sure we were providing events that were valuable, effective, and impactful. For example, we learned about a lot about session timing to avoid screen fatigue so that we didn’t lose our audience’s attention, and we applied those learnings to other events. That’s something we continue to do, particularly as we look toward hybrid events in the near future.”

In addition, virtual convenings can advance conversations among subject matter experts and industry leaders in ways that in-person events don’t.

gatherings can bring together

experts and policymakers in the

same space.

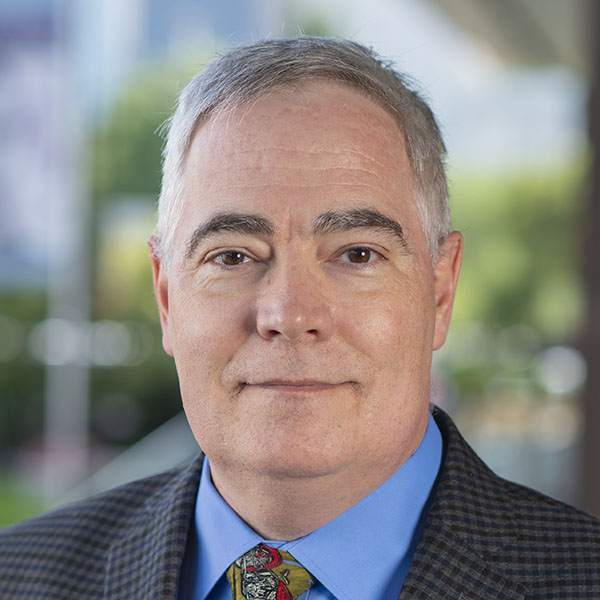

“Virtual events do not have the same intimacy as in-person events since you lose the face-to-face aspect, but what you gain is the ability to gather all of the most important subject matter experts and policymakers in the same place at the same time,” explained Bob Hunt, senior vice president and associate director of the Bank’s Consumer Finance Institute (CFI). “The power of these convenings is incredible and often results in work or progress that simply wouldn’t have happened in in-person meetings.”

The CFI holds several conferences each year. One October conference focusing on artificial intelligence (AI) in consumer finance attracted a diverse group of experts that included Fed experts from across the System, computer scientists from around the globe, examination experts, practitioners from the industry, and more. Hunt believes the presence of those unique perspectives at one time advanced the discussion on AI rulemaking “by about five years.”

We were able to gather the voices that needed to contribute to that conversation, and we couldn’t have done that in person.

Bob Hunt

Bob Hunt

Senior Vice President and Associate Director of the Consumer Finance Institute,

Federal Reserve Bank of Philadelphia

“We need to understand these tools, what they are good at, and where the challenges and concerns are. We were able to gather the voices that needed to contribute to that conversation, and we couldn’t have done that in person,” Hunt continued.

Looking Ahead

Even with all the value brought by virtual meeting platforms, some audiences and conference organizers are eager to get back to in-person convenings. With the success of the Bank’s virtual events, we are looking toward hybrid events as the model for the future, with an eye toward creating a model that ensures that both those in the room and those participating online have a valuable, engaging experience.

virtual space helped connect

us to a global audience.

“We saw the richness in reaching a global audience and don’t want to step backward and limit how many people can participate,” said Rebecca Robinson, Philadelphia Fed assistant vice president of diversity, equity, and inclusion. “But we are seeing the value of expanding our engagement, offering both in-person and virtual opportunities.”

Robinson’s team spearheads the Bank’s annual Diversity, Equity, and Inclusion (DEI) Forum. Held each fall, the forum brings together DEI practitioners and Human Resources professionals to share best practices and insights to make workplaces more diverse and inclusive. The 2021 forum was a milestone — marking our 10th year of hosting the event as well as attracting a record number of registrants.

If we want to reach people outside our District and be seen as a leader in this space, we have to continue to make sure that people globally can access our work and expertise.

Rebecca Robinson

Rebecca Robinson

Assistant Vice President of Diversity, Equity, and Inclusion,

Federal Reserve Bank of Philadelphia

The event drew registration from 350 global participants, up from fewer than 120 participants for the in-person event in 2019, when capacity constraints limited in-person attendance. “If we want to reach people outside our District and be seen as a leader in this space, we have to continue to make sure that people globally can access our work and expertise,” said Robinson.

Jagtiani, organizer of the Fintech Conference, agreed. She emphasized that while keeping virtual opportunities means we can expand and reach more audiences, there are still some important benefits of in-person conferences. “It doesn’t have to be one or the other, in-person or virtual. Our goal isn’t just to listen but engage and network to advance conversations, and that is one strength of in-person events. Hybrid events offer enhanced opportunities to connect and expand our network with the right people.”

- The views expressed here are solely those of the author and do not necessarily reflect the views of the Federal Reserve Bank of Philadelphia or the Federal Reserve System.