The Federal Reserve System does more than just set interest rates: It also collects data from the many banks it supervises. These data are, of course, kept private, but they nonetheless represent a treasure trove of information about the banking industry — especially its lending activities. Plenty of people outside the Fed would benefit from access to this data. And giving them access fulfills Objective 1.4 of the System’s Strategic Plan: “advance public understanding of complex issues and their potential impacts on the economy and financial stability.”1

To fulfill this objective while maintaining the confidentiality of the data, the Philadelphia Fed publishes a quarterly Large Bank Credit Card and Mortgage Data time series based on the System’s FR Y-14M data schedules. This time series aggregates information from U.S. bank holding companies, intermediate holding companies of foreign banks, and covered savings and loan holding companies, each with $100 billion or more in total consolidated assets. These institutions must report credit card or first-lien mortgage data if their portfolio balances exceed $5 billion or are otherwise material relative to Tier 1 capital. The result is a robust, representative sample — about four-fifths of the U.S. bank card market and one-eighth of the residential mortgage market. What’s more, the data include variables not available elsewhere, such as detailed payment behavior and credit line management metrics for credit cards. These details help illuminate banks’ risk management strategies, the overall health of large bank portfolios, and consumers' response to economic stress.

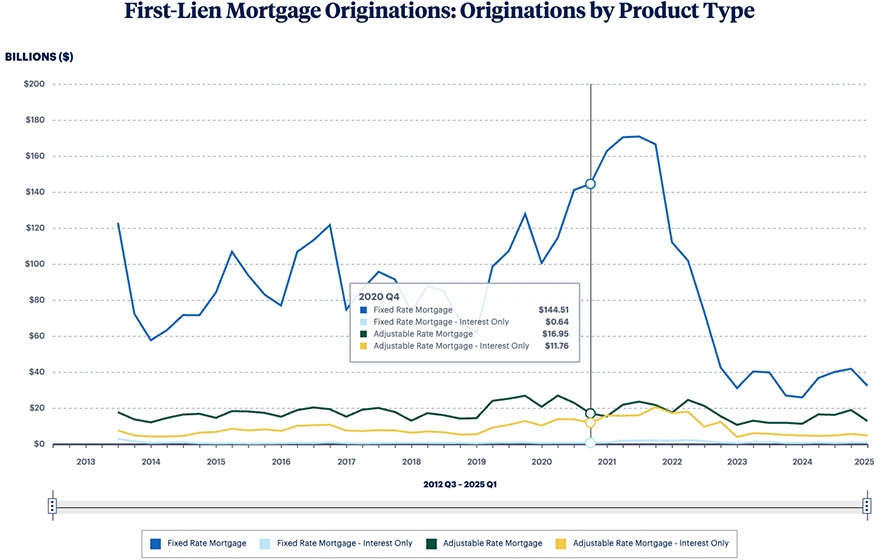

To aid public understanding of this data, the Philadelphia Fed also created an interactive dashboard that allows users to explore trends dating back to 2012. Users can, for example, graph the trend in mortgage origination volumes from 2012 to 2025. Doing so highlights the recent increase in the share of adjustable-rate mortgage (ARM) originations. As noted in the most recent report about this data, "Growth in ARM balances has begun to shift product composition within the large bank mortgage portfolio, but portfolio quality remains robust, contributing to continued strong credit performance."2

The release of these data — previously confidential supervisory information — enhances public understanding of our policymaking and provides a valuable benchmarking tool for researchers and policymakers.

Note: Unknown, null, and “other” values are not included in any subcategory and are excluded from publication. As a result, subcategories do not sum to 100 percent of balances for a given variable category. We estimate that first-lien mortgage portfolio loans in the aggregate FR Y-14M data represent approximately one-eighth of total U.S. residential mortgage market debt. The historical data will be periodically revised.

Learn More: Large Bank Credit Card and Mortgage Data

Email: Phil.LargeBankData@phil.frb.org

- Board of Governors of the Federal Reserve System, “Strategic Plan 2024–27” (December 2023).

- Lauren Berlin and Caleb Hoover, Large Bank Credit Card and Mortgage Data 2025 Q1 Narrative: Q1 2025 Insights Report, Philadelphia: Federal Reserve Bank of Philadelphia, July 8, 2025.

This article appeared in the Third Quarter 2025 issue of Economic Insights. Download and read the full issue.