October 2025 Manufacturing Business Outlook Survey

Note: Survey responses were collected from October 6 to October 13.

Manufacturing activity in the region was mixed, according to the firms responding to the October Manufacturing Business Outlook Survey. The survey’s index for current general activity fell significantly and turned negative, more than offsetting last month’s increase. The shipments index declined but remained positive, while the new orders index rose. The employment index ticked down but continued to reflect overall increases in employment. Both price indexes moved higher and remain elevated. The survey’s future indicators suggest widespread expectations for growth over the next six months.

Current Indicators Are Mixed

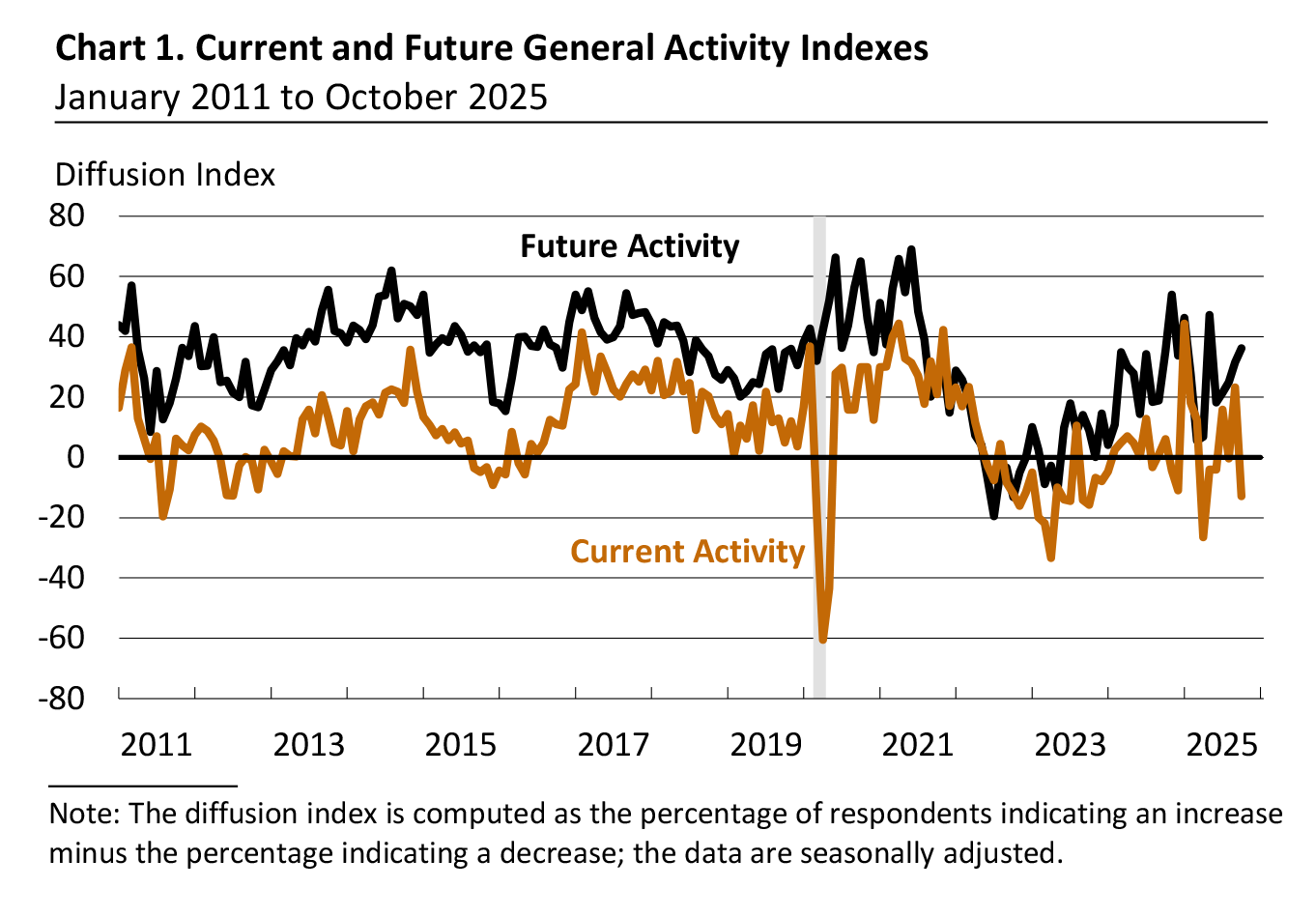

The diffusion index for current general activity dropped 36 points to -12.8 in October, its lowest reading since April (see Chart 1). Twenty-five percent of the firms reported decreases in general activity this month (up from 17 percent last month), while 12 percent reported increases (down from 40 percent); 58 percent reported no change (up from 43 percent). The shipments index fell 20 points but remained positive at 6.0. Meanwhile, the new orders index rose 6 points to 18.2.

On balance, the firms continued to report overall increases in employment this month, and the employment index ticked down 1 point to 4.6. Almost 12 percent of the firms reported increases, while 7 percent reported decreases; 81 percent of the firms reported no change in employment levels. The average workweek index declined to 12.8 from 14.9 in September.

Firms Report Higher-than-Average Overall Price Increases

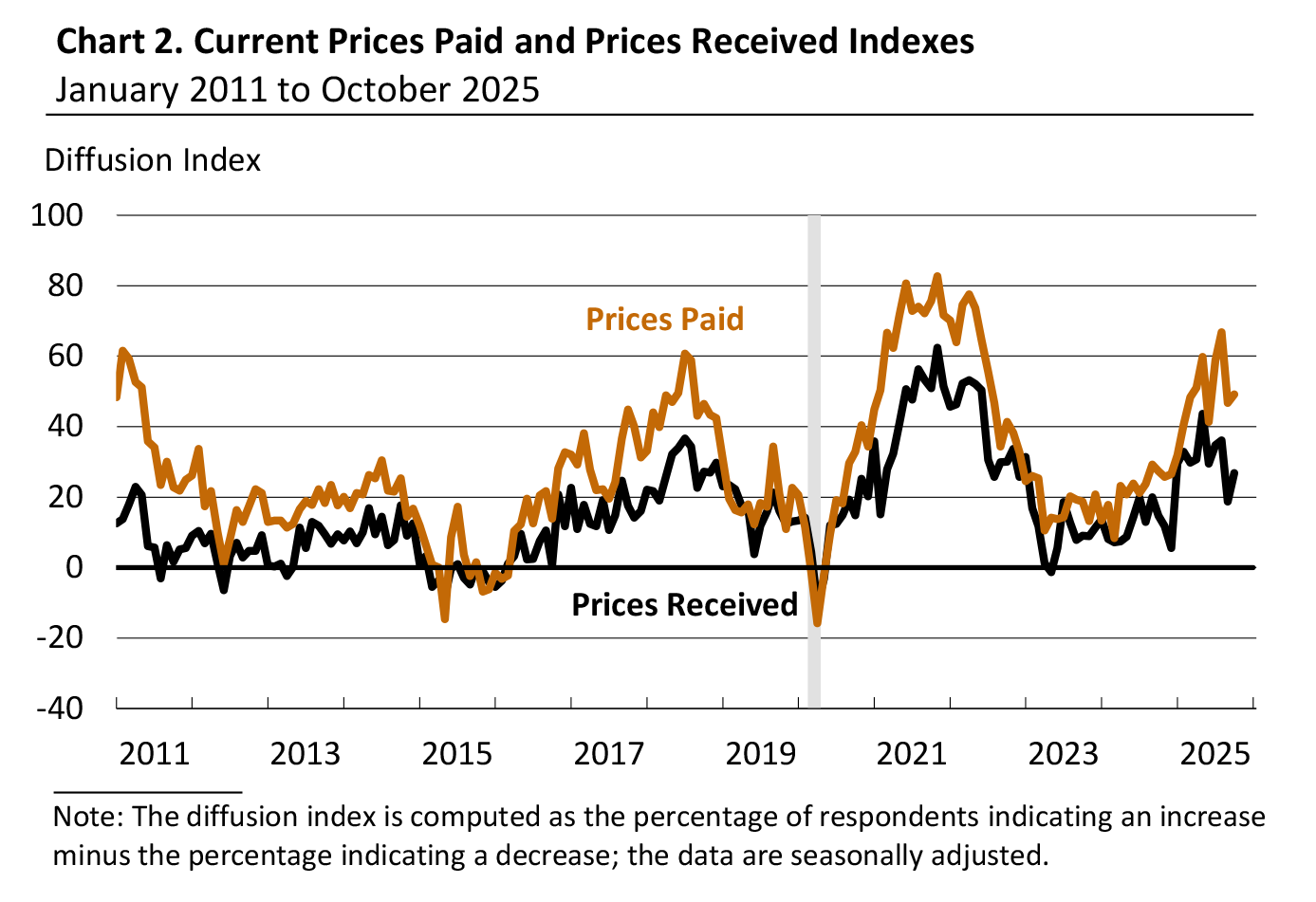

The prices paid index rose 3 points to 49.2 in October, following last month’s fall from a multiyear high (see Chart 2). Over 49 percent of the firms reported increases in input prices, while none reported decreases; 51 percent reported no change. The current prices received index rose 8 points to 26.8 after declining last month. Almost 28 percent of the firms reported increases in prices received for their own goods, 1 percent reported decreases, and 70 percent reported no change. Both price indexes are above their nonrecession averages.

Firms Anticipate Higher Capital Expenditures Next Year

In this month’s special question, manufacturers were asked about their plans for different categories of capital expenditures next year. Almost 36 percent of the firms expect to increase total capital spending, compared with 19 percent expecting to decrease total spending; 45 percent expect total spending to stay the same. When this question was asked last year, the share of firms expecting to increase spending (52 percent) exceeded the share of firms expecting to decrease spending (21 percent). Expectations for higher capital expenditures were most widespread for computer and related hardware, noncomputer equipment, and software. However, at least half the firms expect capital expenditures to stay the same across all categories, except noncomputer equipment.

Firms Continue to Expect Growth

The diffusion index for future general activity rose 5 points to 36.2 in October (see Chart 1). The share of firms expecting increases in activity over the next six months (47 percent) exceeded the share expecting decreases (11 percent); 35 percent expect no change. The future new orders index rose 7 points to 49.8, its highest reading since January, and the future shipments index jumped 17 points to 48.4. Expectations for employment remained widespread but were relatively unchanged at 21.4. Both future price indexes declined but remained elevated compared with their long-run averages. The future prices paid index declined 10 points to 59.8, and the future prices received index fell 19 points to 45.7. The future capital expenditures index increased 13 points to 25.2, partially offsetting last month’s decline. Nearly 30 percent of the firms expected future increases in capital expenditures, while 5 percent expected decreases; 59 percent expected no change.

Summary

Responses to the October Manufacturing Business Outlook Survey suggest regional manufacturing activity was mixed this month. The index for current activity dropped significantly and turned negative, more than offsetting last month’s increase. The indicator for shipments also declined but remained positive, while the new orders index rose for the second consecutive month. The firms continued to indicate overall increases in employment and widespread increases in prices. The survey’s broad indicators for future activity suggest that firms continue to expect growth over the next six months.

Special Question (October 2025)

| Comparing 2026 with 2025, do you expect capital expenditures to be higher, the same, or lower for each of the following categories? | ||||

|---|---|---|---|---|

|

Higher (% of reporters) |

Same (% of reporters) |

Lower (% of reporters) |

Diffusion Index |

|

| Software | 35.5 | 61.3 | 3.2 | 32.3 |

| Noncomputer equipment | 43.8 | 46.9 | 9.4 | 34.4 |

| Energy-saving investments | 13.3 | 76.7 | 10.0 | 3.3 |

| Computer and related hardware | 40.6 | 56.3 | 3.1 | 37.5 |

| Structure | 21.9 | 68.8 | 9.4 | 12.5 |

| Other | 12.5 | 87.5 | 0.0 | 12.5 |

| Total capital spending | 35.5 | 45.2 | 19.4 | 16.1 |

Return to the main page for the Manufacturing Business Outlook Survey.