November 2020 Manufacturing Business Outlook Survey

Note: Survey responses were collected from November 9 to November 16.

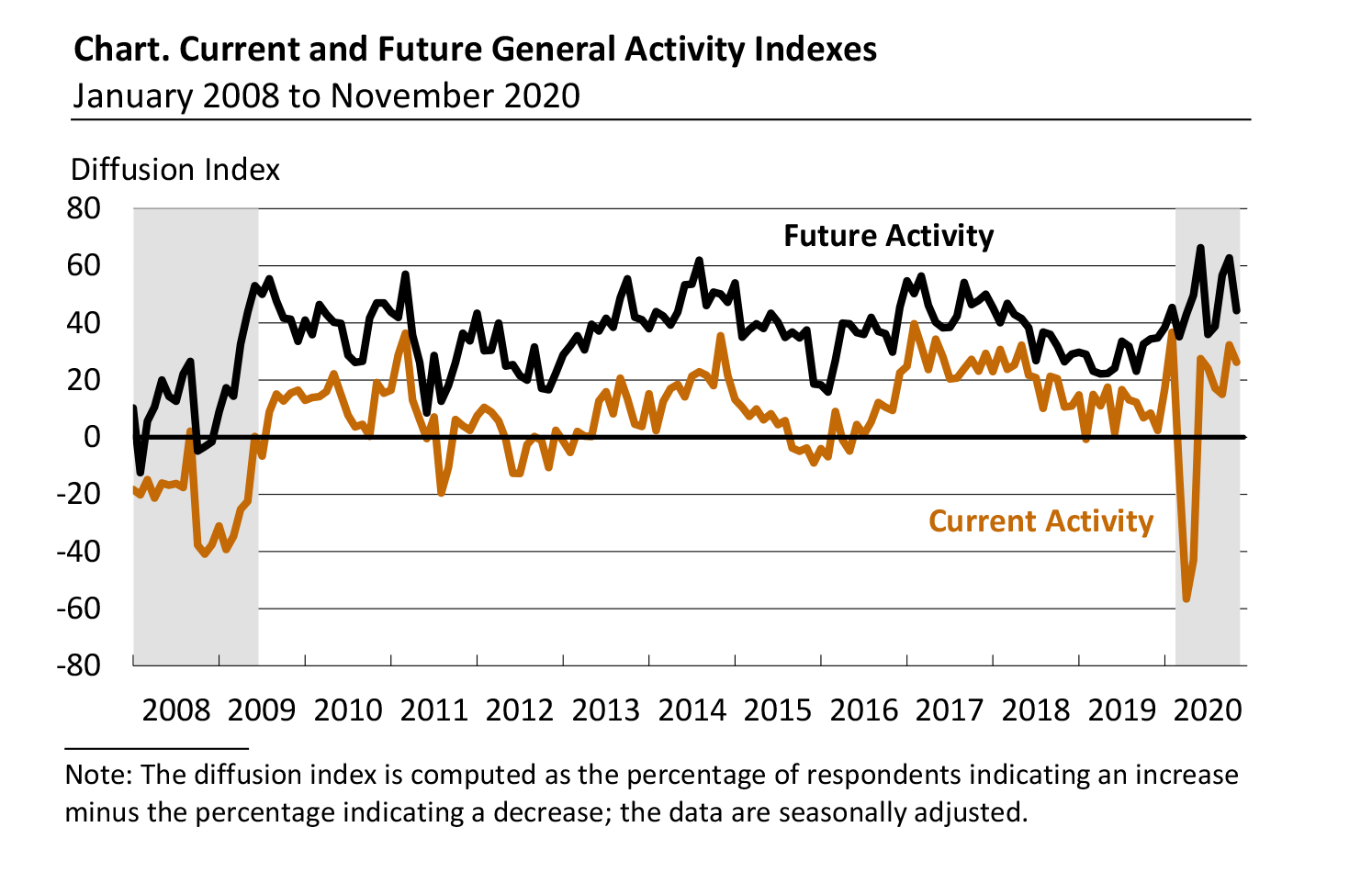

Manufacturing activity in the region continued to grow, according to firms responding to the November Manufacturing Business Outlook Survey. The survey’s current indicators for general activity, new orders, and shipments remained positive for the sixth consecutive month but fell from their readings in October. However, employment increases were more widespread this month. Most future indexes also moderated this month but continue to indicate that firms expect growth over the next six months.

Current Indicators Reflect Continued Recovery

The diffusion index for current activity decreased 6 points to 26.3 in November, its sixth consecutive positive reading after reaching long-term lows in April and May (see Chart). The percentage of firms reporting increases this month (42 percent) exceeded the percentage reporting decreases (15 percent). The index for new orders decreased 5 points to a reading of 37.9. Nearly 49 percent of the firms reported increases in new orders this month, compared with 55 percent last month. The current shipments index fell 22 points to 24.9 in November. Nearly 41 percent of the firms reported higher shipments, compared with 57 percent last month.

On balance, the firms reported increases in manufacturing employment for the fifth consecutive month. The current employment index increased 15 points to 27.2. Employment increases were reported by 34 percent of the firms (up from 23 percent last month), while 7 percent reported decreases. The average workweek index was positive for the fifth consecutive month and was essentially unchanged at 25.7.

Survey Price Indicators Move Higher

Price increases were more widespread this month. The prices paid diffusion index increased 10 points to 38.9. Nearly 39 percent of the firms reported increases in input prices, compared with 29 percent last month; most firms (59 percent) reported no change. The current prices received index, reflecting manufacturers’ own prices, increased 11 points to 25.4. Over 26 percent of the firms reported increases in prices of their own manufactured goods, compared with 14 percent in October.

Firms Expect Own Prices to Match Rate of Inflation

In this month’s special questions, the firms were asked to forecast the changes in the prices of their own products and for U.S. consumers over the next four quarters. Regarding their own prices, the firms’ median forecast was for an increase of 2.0 percent, the same as reported when the question was asked in August. The firms’ actual price change over the past year was 1.0 percent. The firms expect their employee compensation costs (wages plus benefits on a per employee basis) to rise 3.0 percent over the next four quarters, the same as in August. When asked about the rate of inflation for U.S. consumers over the next year, the firms’ median forecast was unchanged at 2.0 percent. The firms’ median forecast for the long-run (10-year average) inflation rate was 2.5 percent, a slight decrease from 2.8 percent in the previous quarter.

Firms’ Outlook Softens but Continued Growth Is Expected

The respondents recorded weaker expectations for growth compared with October. The diffusion index for future general activity decreased 18 points to 44.3 in November (see Chart). The percentage of firms expecting growth over the next six months (60 percent) remained significantly greater than the percentage expecting declines (16 percent). The future new orders index fell 4 points but remains at an elevated reading of 48.1, and the future shipments index decreased 9 points to 43.1 this month. The future employment index decreased 10 points to 36.2. Over 41 percent of the firms expect to increase employment in their manufacturing plants over the next six months, compared with 52 percent in October. The future capital spending index declined 11 points to 25.5.

Summary

Responses to the November Manufacturing Business Outlook Survey suggest continued recovery for the region’s manufacturing sector. Although the indicators for current activity, new orders, and shipments all moderated from last month, the current employment index showed notable improvement. The survey’s future indexes also moderated this month but suggest that growth is expected to continue over the next six months.

Special Questions (November 2020)

| Current |

Previous (August 2020) |

|

For your firm: |

||

| Forecast for next year (2020Q4–2021Q4) | ||

| 1. Prices your firm will receive (for its own goods and services sold). | 2.0 | 2.0 |

| 2. Compensation your firm will pay per employee (for wages and benefits). | 3.0 | 3.0 |

| Last year's price change (2019Q4–2020Q4) | ||

| 3. Prices your firm did receive (for its own goods and services sold) over the last year. | 1.0 | 1.5 |

For U.S. consumers: |

||

| 4. Prices consumers will pay for goods and services over the next year. | 2.0 | 2.0 |

| 5. Prices U.S. consumers will pay for goods and services over the next 10 years (2020–2029). | 2.5 | 2.8 |

| The numbers represent medians of the individual forecasts (percent changes). For question 5, the firms reported a 10-year annual-average change. | ||

Return to the main page for the Manufacturing Business Outlook Survey.