October 2020 Manufacturing Business Outlook Survey

Note: Survey responses were collected from October 5 to October 13.

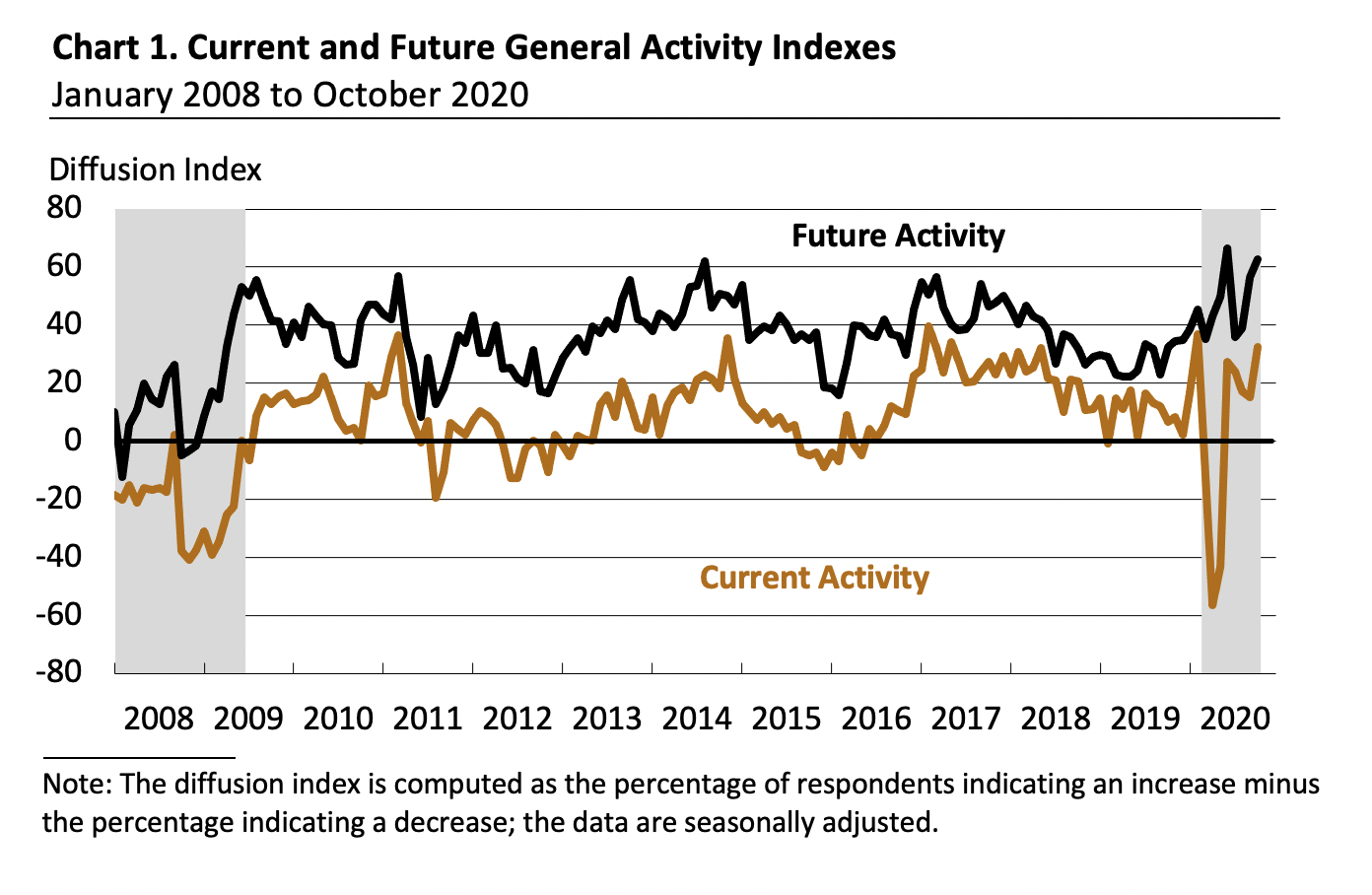

Manufacturing activity in the region picked up this month, according to firms responding to the October Manufacturing Business Outlook Survey. The survey’s current indicators for general activity, new orders, and shipments all showed notable improvement. Most future indexes increased and continue to reflect optimism among firms about growth over the next six months.

Most Current Indicators Show Improvement

The diffusion index for current activity increased 17 points to 32.3 in October, its fifth consecutive positive reading after reaching long-term lows in April and May (see Chart 1). The percentage of firms reporting increases this month (47 percent) exceeded the percentage reporting decreases (15 percent). The index for new orders rose 17 points to a reading of 42.6. Nearly 55 percent of the firms reported increases in new orders this month, compared with 42 percent last month. The current shipments index also increased 10 points to 46.5 in October.

On balance, the firms reported increases in manufacturing employment for the fourth consecutive month. The current employment index, however, fell 3 points to 12.7 this month (see Chart 2). Employment increases were reported by 23 percent of the firms, while 10 percent reported decreases. The average workweek index was positive for the fourth consecutive month and increased 18 points to 25.3.

Most Firms Report Steady Prices

The survey’s price indicators suggest modest price pressure. The prices paid diffusion index increased 3 points to 28.5. Nearly 29 percent of the firms reported increases in input prices, and none reported decreases; most firms (72 percent) reported no change. The current prices received index, reflecting manufacturers’ own prices, decreased 4 points to 14.0. Just 14 percent of the firms reported increases in prices of their own manufactured goods, while 86 percent reported no change in prices.

Total Capital Spending Influenced by Policy Uncertainty and COVID-19 Effects

For this month's special questions, manufacturers were asked about current capacity utilization rates compared with the same time last year (see Special Questions). The median capacity utilization rate reported among the firms was 72.5 percent, down from 82.5 percent estimated one year earlier. Firms were asked to forecast total capital spending for 2021 compared with levels in 2020, and more firms indicated that they would increase spending (37 percent) than decrease spending (12 percent). The firms were also asked about their plans for different categories of capital spending next year. For all five categories of investment spending (software, noncomputer equipment, computer equipment, structure, and energy-saving investments), the share of firms expecting to increase spending was higher than the share of firms expecting to decrease spending. On balance, the firms expect larger increases for software and noncomputer equipment. The firms were also asked about the impact of economic policy uncertainty and the effects of COVID-19 on their total capital spending plans for next year. The firms indicated net negative effects from both, with more firms indicating decreases due to the pandemic (48 percent) compared with policy uncertainty (23 percent).

Firms Remain Optimistic About Future Growth

The respondents remained optimistic about growth over the next six months. The diffusion index for future general activity increased 6 points to 62.7 in October, its highest reading since June (see Chart 1). The future new orders index fell 5 points but remains at an elevated reading of 51.6, and the future shipments index edged up 4 points to 51.7 this month. The firms continued to expect increases in employment over the next six months, with the future employment index increasing 3 points (see Chart 2). Over 52 percent of the firms expected higher employment over the next six months. The index for future capital spending increased 6 points to 36.5.

Summary

Responses to the October Manufacturing Business Outlook Survey suggest a pickup in activity for the region’s manufacturing sector. The indicators for current activity, new orders, and shipments all increased this month. Special questions about firms’ current capacity utilization reflect the sizable impact of COVID-19, inasmuch as firms, on balance, report operating at notably lower levels of capacity than one year ago. The survey’s future indexes suggest continued widespread optimism about manufacturing activity over the next six months.

Special Questions (October 2020)

| 1. Which of the following best characterizes your plant’s current capacity utilization rate (current and last year)? | |||

|---|---|---|---|

| Capacity Utilization Rate |

Current (% of reporters) |

Same Time Last Year (% of reporters) |

|

| Less than 60% | 14.3 | 0.0 | |

| 60%–70% | 19.0 | 11.9 | |

| 70%–80% | 31.0 | 14.4 | |

| 80%–90% | 28.6 | 54.8 | |

| Greater than 90% | 7.2 | 19.0 | |

| Median utilization rate* | 72.5 | 82.5 | |

|

* The firms provided more specific rates of utilization than shown in the provided ranges. |

|||

| 2. Do you expect the following capital expenditure categories over the next year (2021) to be higher than, the same, or lower than in the current year? | ||||

|---|---|---|---|---|

| Higher (% of reporters) |

Same (% of reporters) |

Lower (% of reporters) |

Diffusion Index | |

| Software | 38.1 | 59.5 | 2.4 | 35.7 |

| Noncomputer equipment |

41.9 |

42.9 | 16.3 | 25.6 |

| Computer and related hardware | 23.8 | 69.0 | 7.1 | 16.7 |

| Structure |

21.4 |

57.1 | 13.2 | 8.2 |

| Energy-saving investments |

13.2 |

69.0 | 10.5 | 2.7 |

| Total capital spending | 36.6 | 51.2 | 12.2 | 24.4 |

| 3. How have each of the two factors, economic policy uncertainty and COVID-19 effects, affected your expected capital spending for 2021 compared with 2020? | ||

|---|---|---|

| Economic Policy Uncertainty |

COVID-19 Effects | |

| Significantly increase | 5.0 | 0.0 |

| Modestly increase | 5.0 | 10.0 |

| Subtotal | 10.0 | 10.0 |

| No change | 67.5 | 35.0 |

| Modestly decrease | 20.0 | 30.0 |

| Significantly decrease | 2.5 | 17.5 |

| Subtotal | 22.5 | 47.5 |

Return to the main page for the Manufacturing Business Outlook Survey.