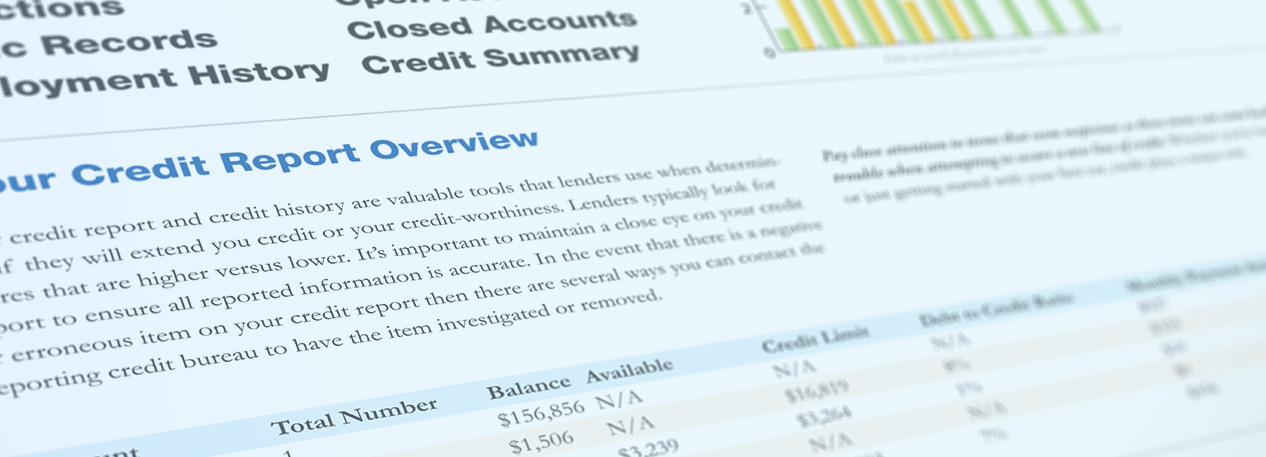

Understanding the contents of one’s credit report can be critical to consumers’ ability to obtain affordable credit and to their ability to manage their finances generally. Surveys often ask respondents to report the types and amounts of credit they have, but it is often difficult or impossible to determine if the reported information is accurate. In this paper, we examine how well individuals’ self-reported credit activities in surveys correspond to the administrative data in their credit bureau files. We use anonymized survey data linked with individual-level administrative credit records to assess the levels of agreement between the two data sources for key credit-related attributes — such as credit seeking, credit account ownership, and outstanding balances — across several widely used credit products, such as credit cards, mortgages, and auto loans. We find that survey self-reports generally align well with administrative data, with a large majority of respondents reporting the composition and balances of their existing credit accounts as well as new credit applications in a manner consistent with their credit records. Agreement between the two data sources is generally higher for credit seeking and account ownership than for account balances, higher for installment loans than for revolving credit, and higher for credit products used more frequently than those used less often. When there is disagreement, there is a greater tendency to underreport rather than overreport in surveys, especially for account balances. Additionally, more often than not, demographic characteristics do not explain the level of agreement or disagreement between self-reports and credit records.

View the Full Discussion Paper

Discussion Paper

How Well Do Survey Self-Reports Align with Administrative Data? The Case of U.S. Consumer Credit Records

September 2025

DP 25-01 – This paper assesses how closely consumers’ self-reported credit and debt attributes (such as credit account ownership and balances) align with administrative credit bureau records for mortgages, auto loans, and credit cards.