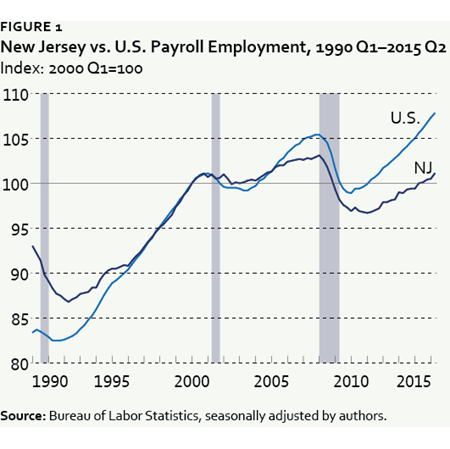

Indeed, the number of jobs in New Jersey grew relatively steadily in the 1980s and 1990s, and the state’s job growth rate had been right on track with the nation’s before the 2001 recession hit.

Yet, the past 15-plus years have been a very different story. New Jersey’s payroll employment since 2000 has grown less than 1 percent as of the second quarter of 2015, far below the U.S. growth rate of 7.8 percent over that time. Part of the blame for New Jersey’s decade and a half of job stagnation belongs, of course, to the Great Recession of 2007–2009. And New Jersey is far from alone in not having made up all the jobs it lost as a result of that severe downturn.

Even so, its employment recovery has been particularly weak compared with other states. New Jersey’s job growth rate of -2.2 percent since its prerecession peak places it 46th in employment recovery status among the 50 states. Despite its considerable advantages, New Jersey has been outpaced by a U.S. jobs recovery that itself has not been considered vigorous by historical standards. While the U.S. overall surpassed its prerecession peak employment level in mid-2014,1 New Jersey remains nearly 90,000 jobs short, the deepest hole in absolute terms among the 15 most populous states.

This gap is all the more troubling when one considers that the state’s need for jobs has only increased over that time as the population has risen2 and as more young people graduate and seek work.

What’s keeping New Jersey behind the pack? Why has its recovery from the Great Recession lagged the nation’s? Perhaps especially puzzling, why has the strength of the Philadelphia and New York City job markets not spilled over to their respective bedroom communities in New Jersey?

A new Philadelphia Fed analysis looks beyond the ups and downs of the past two recessions for underlying factors that could explain New Jersey’s dim jobs picture. It seeks to isolate deeper factors in the state’s industrial structure that may be constraining employment.

The recent Research Brief by Adam Scavette and Ethan Haswell documents that several of New Jersey’s industries are in a poor competitive position compared with firms in those same industries operating in other states. Moreover, New Jersey’s jobs are concentrated in these uncompetitive industries, which include information services; professional, scientific, and technical services; and health care and social assistance. In other words, a significant share of the state’s workers are employed in industries in which the state is struggling to compete. When jobs are concentrated in uncompetitive industries, employment expands more slowly.

Why would New Jersey be experiencing this overconcentration of workers in its less competitive industries? The analysis looks at the state’s urban-suburban makeup for clues. When New Jersey was adding jobs steadily in the 1980s and 1990s, its ample supply of low-density office complexes outside the urban centers of Philadelphia and New York City gave it an edge in attracting knowledge-based service sector employers such as financial services firms.

Employment Growth Rates, January 2008—August 2015

| New York City | 11.8% |

| Philadelphia | 4.0 |

| New Jersey | -2.2 |

| Sources: Bureau of Labor Statistics and authors' calculations. |

Since then, however, tastes have changed. Firms in these industries have been gravitating toward densely populated, walkable areas served by commuter rail lines.3 In the meantime, these city-based industries have grown less competitive; that is, they are adding jobs at a slower rate than the national rates of employment growth for those industries.

Though a number of factors can drive job gains in an industry — tax incentives, for instance — rapid employment growth is generally associated with high productivity. Comparing the locations of urban- versus suburban-based industries, it turns out that city-centric industries in New Jersey are generally less competitive than firms in those industries nationwide. Their shift away from the state’s suburban office parks and into the urban centers of Philadelphia and New York City appears to have curbed workforce expansion in these industries in New Jersey compared with these same industries in the U.S. overall.

At the same time, industries concentrated in the New Jersey suburbs tend to have faster job growth but smaller workforces than those industries nationwide. In other words, the migration of certain industries to big cities over the past decade and a half has left the state with a lopsided allocation of workers in relatively uncompetitive industries. The authors note that New Jersey’s economy relies significantly on services, while many services jobs are now clustering in cities, especially higher-paying service jobs.

New Jersey Profile

| Population | 8.98 million / 1.195 per square mile |

|---|---|

| Income | $72,062 median household income. |

| Education | 36.4% of residents age 25 and older have a bachelor’s degree or higher. |

| Source: Census Bureau, http://www.census.gov/quickfacts/table/PST045215/34 | |

- http://www.pewresearch.org/fact-tank/2014/06/06/chart-of-the-week-how-u-s-regained-all-its-lost-jobs-but-still-fell-behind/.

- The Census Bureau estimates that as of July 2015, New Jersey’s population had risen 1.89 percent since the 2010 census.

- This shift in location preferences has been observed, at least anecdotally, in other states, including Delaware. See, for instance, a New York Times article from August 2, 2016, focusing on employers https://www.nytimes.com/2016/08/02/business/economy/why-corporate-america-is-leaving-the-suburbs-for-the-city.html and an NJSpotlight article and map from May 20, 2016, focusing on households http://www.njspotlight.com/stories/16/05/20/interactive-map-new-jersey-s-boomburbs-shrink-counties-closer-to-nyc-thrive/.