September 2021 Nonmanufacturing Business Outlook Survey

Note: Survey responses were collected from September 7 to September 16.

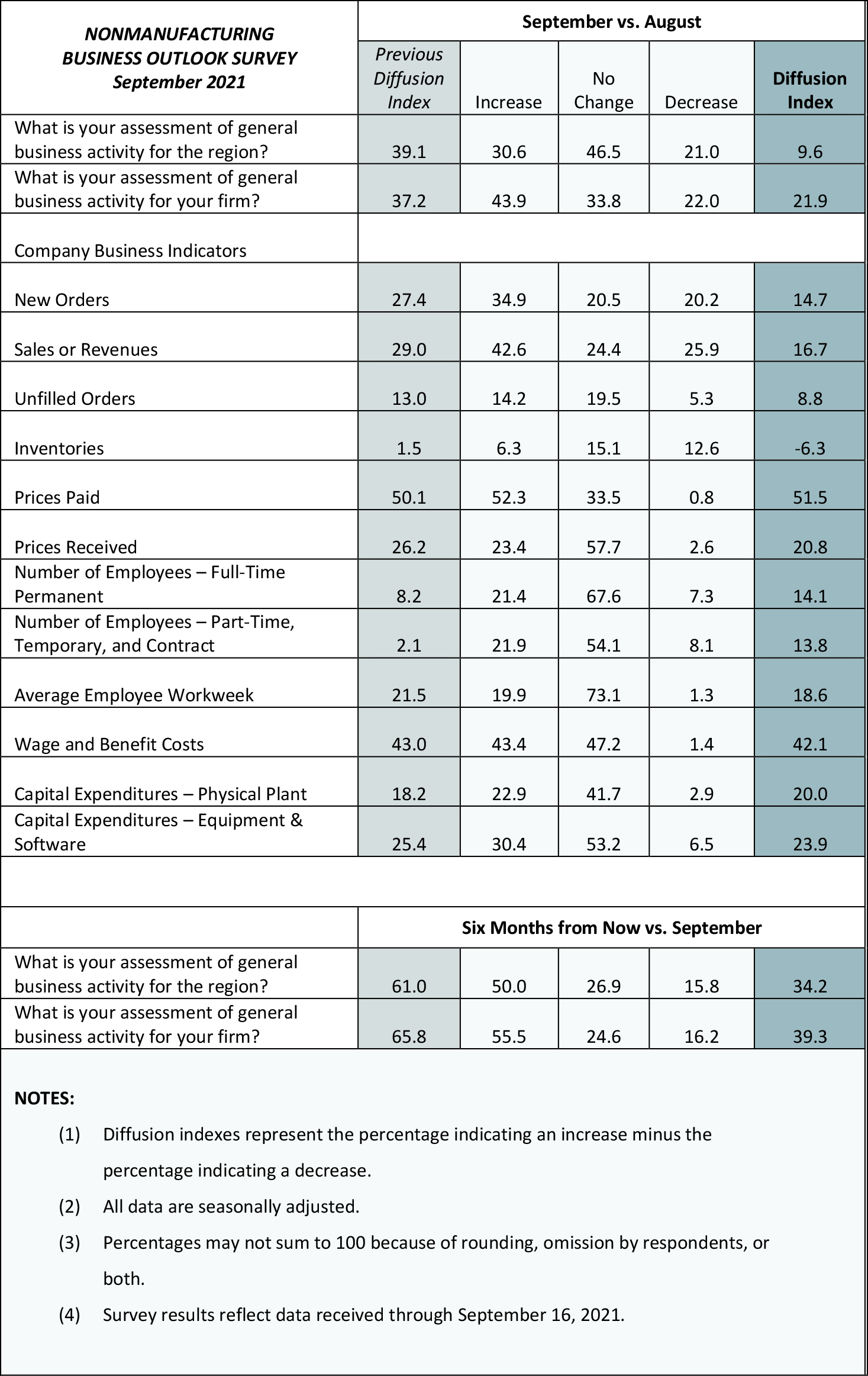

Responses to the September Nonmanufacturing Business Outlook Survey suggest continued growth in business activity in the region. However, the indicators for firm-level general activity, new orders, and sales/revenues all declined from last month. The survey’s indexes for full-time and part-time employment rose. Overall, the respondents continued to expect improvement in conditions over the next six months, but both future activity indexes fell.

Current Indicators Moderate but Remain Positive

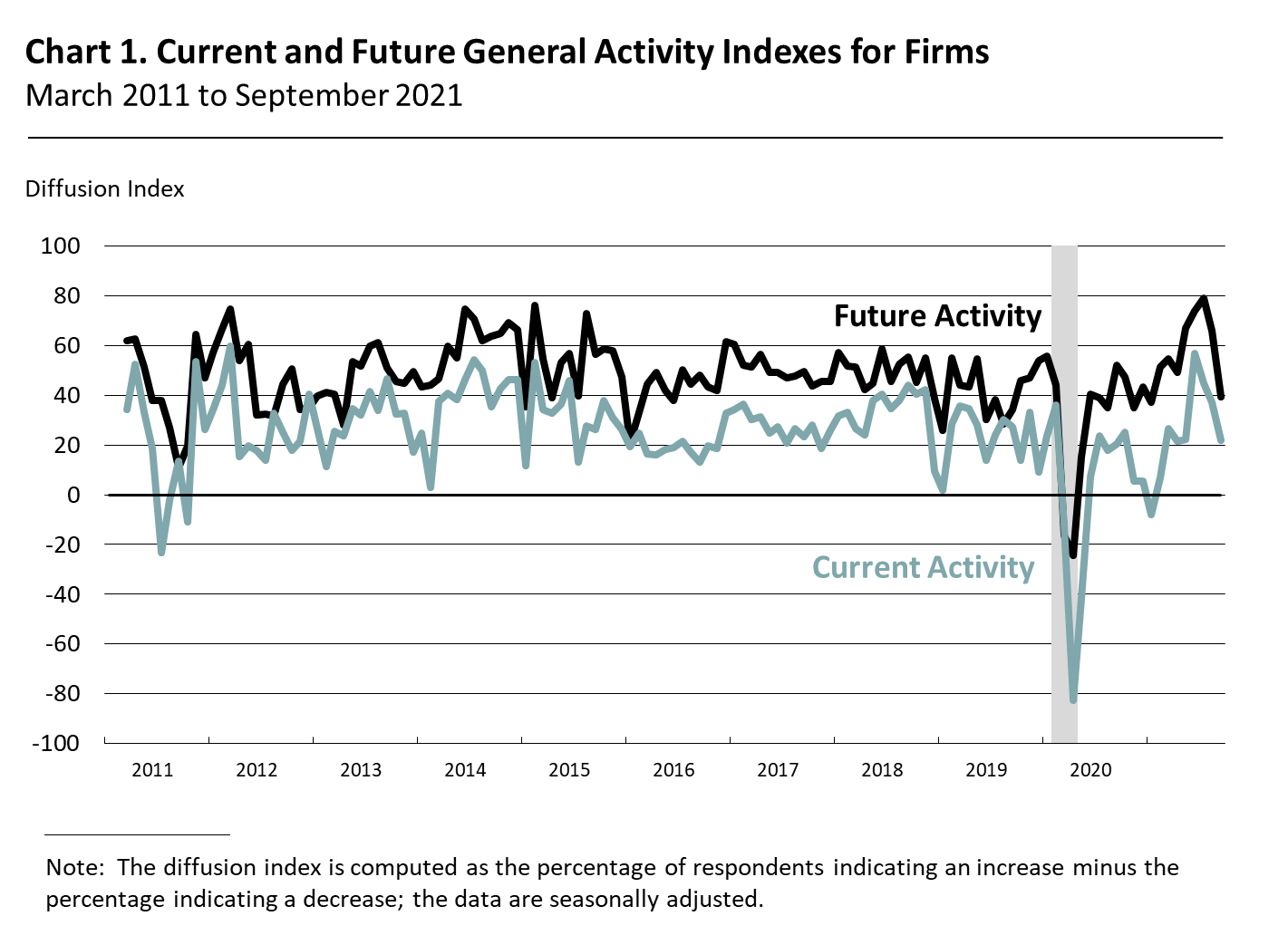

The diffusion index for current general activity declined for the third consecutive month, falling from 37.2 in August to 21.9 this month, its lowest reading since April (see Chart 1). The share of firms reporting increases in general activity (44 percent) exceeded the share reporting decreases (22 percent); however, the share of firms reporting decreases nearly doubled from last month. The new orders index declined 13 points to 14.7 in September. The sales/revenues index fell from 29.0 in August to 16.7 in September. While 43 percent of the firms reported increases in sales/revenues (unchanged from last month), 26 percent reported decreases (up from 14 percent), and 24 percent reported no change (down from 33 percent). The current regional activity index decreased 30 points to 9.6 in September.

Employment Indicators Improve

The firms continued to report overall increases in full-time and part-time employment this month. The full-time employment index rose 6 points to 14.1 after falling 17 points last month. Of the firms responding, 21 percent reported increases in full-time employment, while 7 percent reported decreases. Most firms (68 percent) reported stable full-time employment. The part-time employment index increased 12 points to 13.8. Most firms reported steady part-time employment (54 percent), while 22 percent of the firms reported increases and 8 percent reported decreases.

Price Increases Remain Widespread

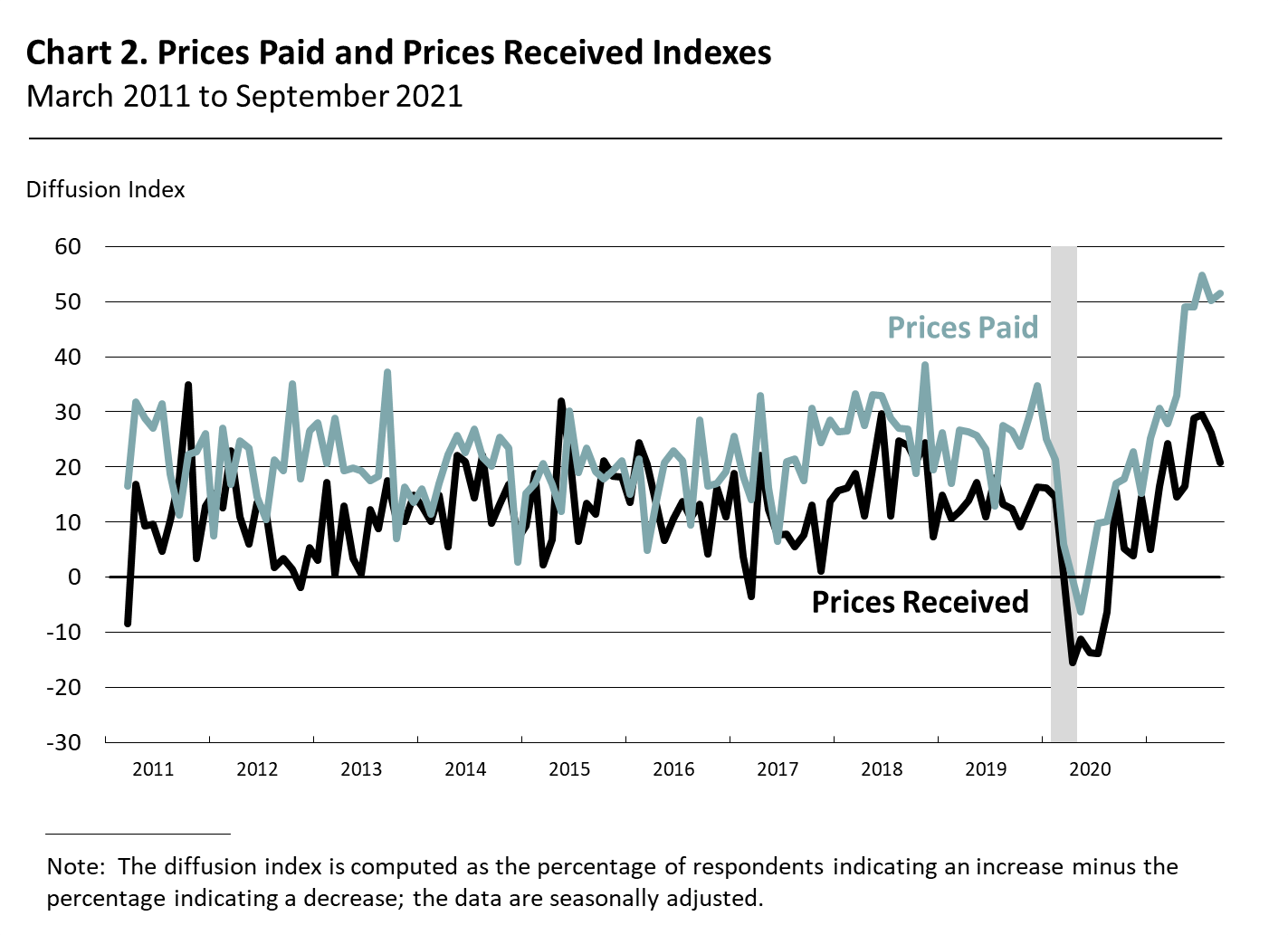

The prices paid index ticked up 1 point this month to 51.5 (see Chart 2). More than 52 percent of the firms reported increases, 1 percent reported decreases, and 34 percent of the firms reported stable input prices. Regarding prices for the firms’ own goods and services, the prices received index fell 5 points to 20.8 in September. More than 23 percent of the firms reported increases in prices received, while only 3 percent reported decreases. Nearly 58 percent of the firms reported no change in prices for their own goods and services.

Firms Report Higher Sales/Revenues and Labor Issues

In this month’s special questions, the firms were asked to estimate their total sales/revenues growth for the third quarter ending this month compared with the second quarter of 2021 (see Special Questions). The share of firms reporting expected increases in third-quarter sales/revenues (41 percent) was greater than the share reporting decreases (28 percent), with a median response of an increase of 0 to 5 percent. Among factors constraining current business operations, 51 percent of the firms reported labor issues, 36 percent reported supply chain issues, and 34 percent reported COVID-19 mitigation measures.

Future Indicators Soften

Both future activity indexes suggest that while the respondents expect overall improvement in nonmanufacturing activity over the next six months, optimism for future growth waned this month. The diffusion index for future activity at the firm level fell sharply from a reading of 65.8 in August to 39.3 this month, its lowest reading since January (see Chart 1). Nearly 56 percent of the firms expect an increase in activity (down from 69 percent last month) at their firms over the next six months, compared with 16 percent that expect decreases (up from 4 percent). The future regional activity index fell 27 points to 34.2.

Summary

Responses to this month’s Nonmanufacturing Business Outlook Survey suggest some moderation in nonmanufacturing activity growth in the region. The indicators for firm-level general activity, new orders, and sales/revenues all declined but remained positive; however, the full-time employment index increased. The future activity indexes suggest that respondents expect improvement at their firms and in the region over the next six months, but readings decreased from last month.

Special Questions (September 2021)

| 1. How will your firm’s total sales/revenues for the third quarter of 2021 compare with those of the second quarter? | ||||

|---|---|---|---|---|

| An increase of: | % of firms | Subtotals | ||

| 20% or more | 3.5 | % of firms reporting an increase: 41.2 | ||

| 15-20% | 1.2 | |||

| 10-15% | 3.5 | |||

| 5-10% | 11.8 | |||

| 0-5% | 21.2 | |||

| No change | 30.6 | |||

| A decline of: | ||||

| 0-5% | 9.4 | % of firms reporting a decrease: 28.2 | ||

| 5-10% | 7.1 | |||

| 10-15% | 2.4 | |||

| 15-20% | 3.5 | |||

| 20% or more | 5.8 | |||

| 2. Have any of the factors below acted as constraints on business operations this quarter?* | |

|---|---|

| % of Reporters | |

| Labor issues | 51.2 |

| Supply chain issues | 36.1 |

| COVID-19 mitigation measures (e.g., reduced operations, distancing) | 33.7 |

| Other factors | 9.3 |

| *Percentages will not add to 100 because more than one factor could be selected. | |

Summary of Returns (September 2021)

Return to the main page for the Nonmanufacturing Business Outlook Survey.