Large Bank Credit Card and Mortgage Data 2022 Q3 Narrative

Q3 2022 Insights Report

by Lincy Chacko & Caleb Hoover Published: January 13, 2023

Mortgage Loan-to-Value Rising; Card Balances Bounce Back from Pandemic Lows

Large bank credit card volume shows strong demand from consumers in the third quarter of 2022, ahead of fourth quarter holiday spending. Originations on a dollar basis are higher than any period within the reported time series, with corresponding increases in credit limits. Credit card balances demonstrated significant growth, as new accounts, utilization rates, and revolving balances continue to trend higher and return to historical norms.

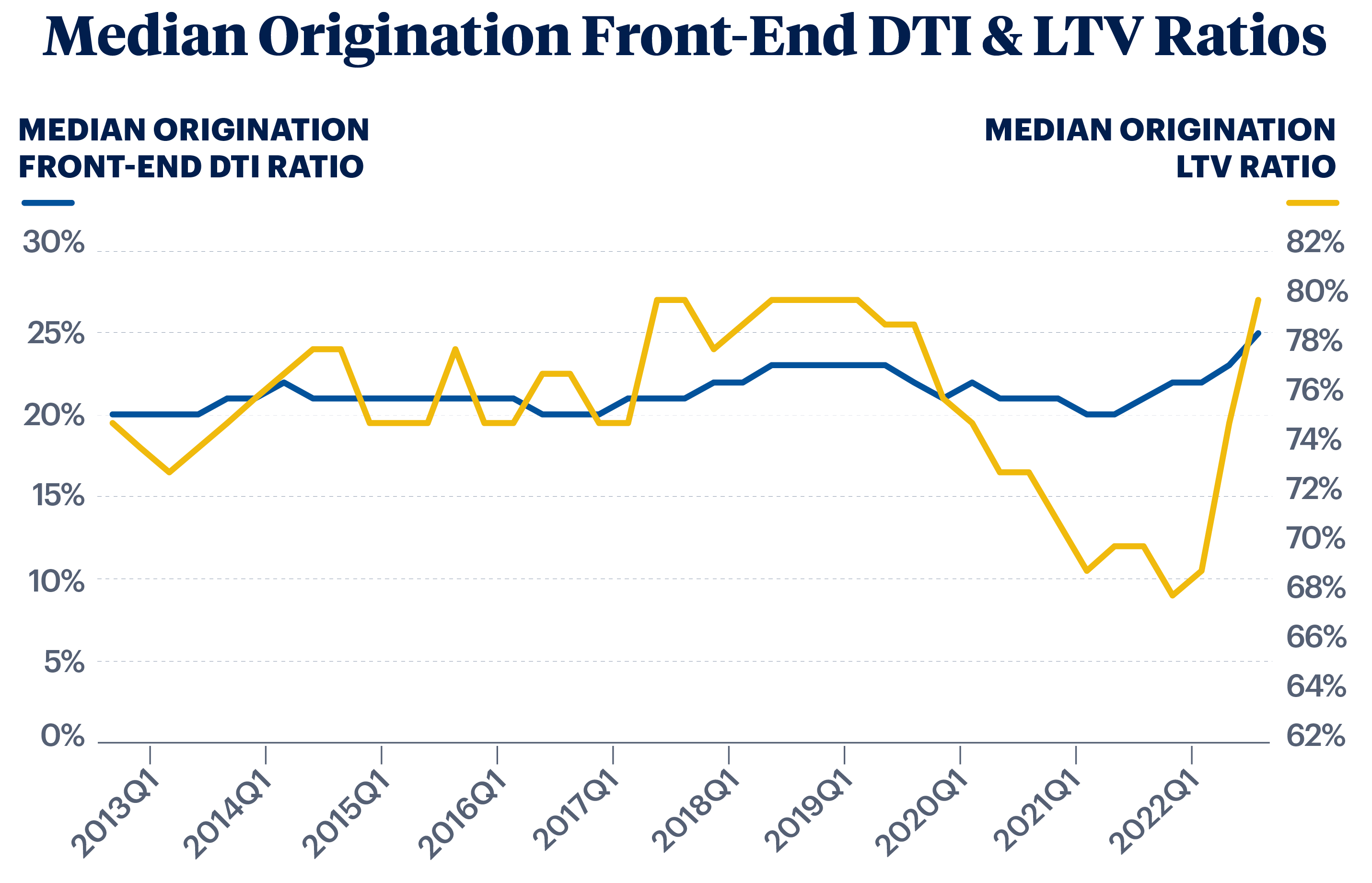

Elevated mortgage rates and historically high home prices have combined to quell mortgage demand. Despite the first quarterly decrease in the national Case-Shiller Home Price Index since 2012, large bank mortgage originations fell precipitously in the third quarter of 2022, reaching their lowest volume since the first quarter of 2019. The number of new accounts on large bank ledgers fell to its lowest level on record. Median origination loan size, loan- to-value (LTV), and front-end debt-to-income (DTI) ratios have risen 27 percent, 10 percentage points, and 4 percentage points year-over-year (YOY), respectively, further underscoring the affordability issues that many borrowers are struggling with in an inflationary environment.

For additional questions or feedback about this data and report, please email Phil.LargeBankData@phil.frb.org.

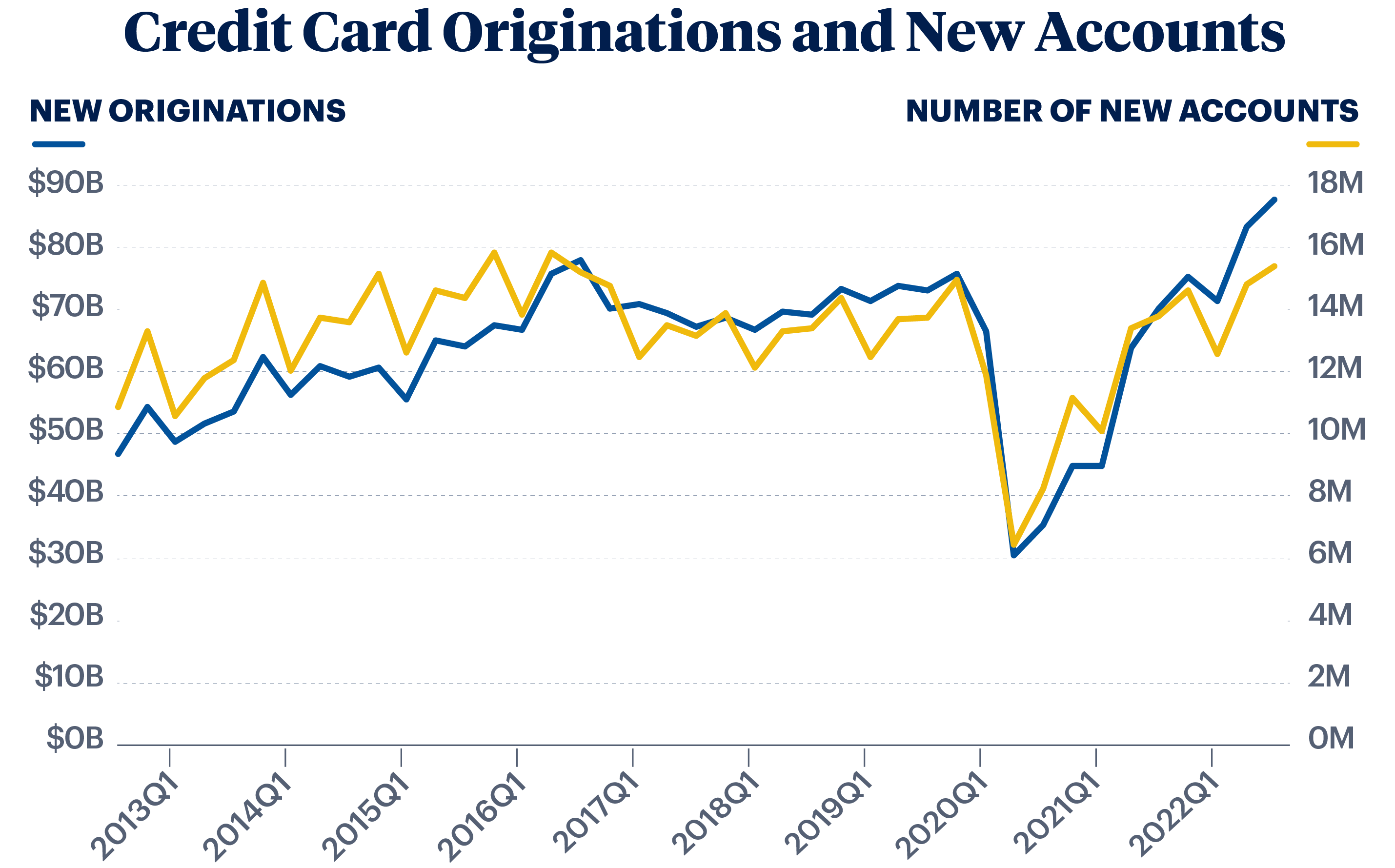

Credit Card Originations at an All-Time High

After bottoming out at the height of the pandemic, credit card origination balances reached a series high during the third quarter of 2022. The number of new accounts surpassed third quarter 2019 levels by almost 12 percent, while average credit limits on new accounts have also risen in the past year. Unlike other consumer credit products, where demand is anticipated to decline or remain stable, a recent Credit Access Survey by the Federal Reserve Bank of New York indicates a higher average likelihood of households applying for a new credit card or credit line increase over the next 12 months.

Credit Card Utilization and Delinquency Normalizing

The demand for new originations was matched by strong balance growth throughout 2022. During the early stages of the pandemic, consumers slowed purchases and paid down existing debt. Balance metrics shifted, as consumers used less of their credit lines, made more full balance payments, and revolved fewer balances. Delinquency rates also reached historic lows. Recent data indicate a shift to prepandemic norms. Utilization and delinquency rates increased, while the share of accounts making full balance payments declined from 2021 peaks. Revolving balances are also recovering from pandemic lows.

Credit Card Metrics

| Quarter | Utilization Rate (average) | Share of Accounts Making Full Balance Payment | Revolving Balances as a Share of Total Balances | 30+ Days Past Due Delinquency Rate |

|---|---|---|---|---|

| 2019Q3 | 20.3% | 32.7% | 71.1% | 2.6% |

| 2020Q3 | 18.2% | 34.5% | 71.6% | 2.0% |

| 2021Q3 | 17.6% | 37.2% | 66.3% | 1.5% |

| 2022Q3 | 19.0% | 35.7% | 66.6% | 2.0% |

Despite Declining Home Prices, Borrowing Costs Climb

New originations in the large bank mortgage portfolio indicate rising borrowing costs for home buyers, despite initial signs of price relief. In the third quarter of 2022, median new origination front-end DTI ratios reached 25 percent, the highest reported level since the FR Y-14M began in 2012. Declining home prices have been outpaced by rising interest rates. Average 30-year fixed mortgage rates rose 3.7 percentage points from September 2021 to September 2022. As refinance incentives have dwindled, purchase loans now compose a higher share of originations, pushing new origination median LTVs upward.

- Disclaimer: The views expressed in this report are solely those of the authors and do not necessarily reflect the views of the Federal Reserve Bank of Philadelphia or the Federal Reserve System.

Note that historical data will be revised periodically for firms that have started or stopped reporting FR Y-14M data and the panel of published FR Y-14M reporters is adjusted. Therefore, historical values may change over time. Please see our data methodology for further details.