Studies1 show that, from 2000 to 2010, there was a rapid decline in rental affordability, with rent increases occurring in the face of stagnant or declining incomes in nearly every metropolitan area and across almost every quintile of the income distribution during that period.

For example, renter households at the 40th percentile of the income distribution in Philadelphia saw their income decrease by 15 percent, while their rents increased by almost 12 percent during this period.2 Low-income households have been particularly affected by an increasingly unaffordable rental market. A recent report3 by the Federal Reserve Bank of Philadelphia found that the number of affordable rental units for every 100 very low-income renter households fell from 82 to 68 between 2005 and 2014. The decline in affordable rental units on the private market makes understanding the presence — and loss — of subsidized rental housing all the more important.

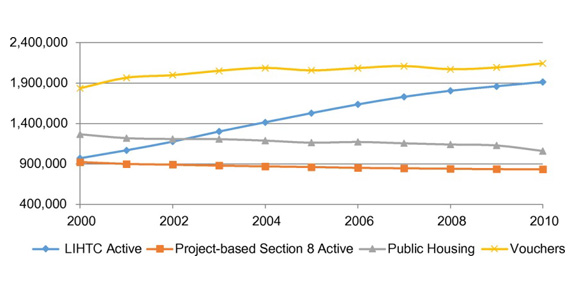

The federal government provides financing and/or rental support for millions of units of affordable rental housing across the U.S. The largest federal programs are the Low-Income Housing Tax Credit (LIHTC), Project-Based Section 8 Rental Assistance, Public Housing, and Section 8 Voucher programs. The first three programs offer subsides at the building level, while the voucher program is designed to be a subsidy that moves with the low-income household. It is estimated that almost 4 million affordable housing units nationally have been financed through these programs (Figure 1), although the exact number is often difficult to determine because many of the properties receive more than one form of subsidy. For example, a study4 found that nearly one-third of all subsidized properties in New York City received two or more forms of public subsidy. And while there are millions of units of federally subsidized rental housing, these units represent an increasingly small share of the overall rental stock.

Figure 1: Housing subsidies, 2000 to 2010

Source: Michael C. Lens and Vincent Reina, “Preserving Neighborhood Opportunity: Where Federal Housing Subsidies Expire,” Housing Policy Debate 26:4–5 (2016), pp. 714–732; available at http://www.tandfonline.com/doi/pdf/10.1080/10511482.2016.1195422.

One factor challenging the existing subsidized housing stock is that owners can, and do, exit subsidy programs. In the 1960s, the federal government shifted from a public ownership model to a private one. Under this paradigm, private owners receive a subsidy to develop affordable housing and maintain it as such for a fixed period of time. At the end of that period, owners can renew the existing subsidy, apply for a new one, or exit all affordable housing programs. Incidentally, as the demand for rental units increased in the late 1990s and the 2000s, and there were fewer private market affordable rental units, private owners of federally subsidized rental housing started to become eligible to exit U. S. Department of Housing and Urban Development (HUD) affordable housing programs, such as the Project-Based Section 8 Rental Assistance program.

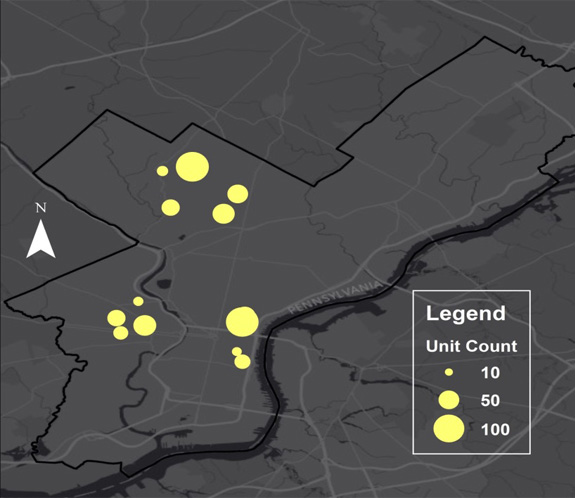

The project-based Section 8 program was created under the Housing and Community Development Act of 1974 and financed the development of 1.2 million privately owned units before it was defunded in 1983. Through this program, tenants’ rent payments are capped at 30 percent of their income, and the difference between their rent payment and the market rent for the unit is paid to the property owner by HUD. To date, almost 150,000 units have exited the project-based Section 8 program, and nearly all properties that remain in it will be eligible to exit in the coming years. Between 1998 and 2010, there were nearly 1,000 households living in properties in the Philadelphia metropolitan area where the project-based Section 8 contract ended; nearly 900 in the Newark–Union (NJ) metro area; more than 7,500 in the New York City metro area; and more than 3,500 in the Washington, D.C., metro area.5 As seen in Figure 2, the properties in Philadelphia are dispersed in three clusters, with some, like those in center city and West Philadelphia, being located in increasingly unaffordable neighborhoods. The previously mentioned study from the Philadelphia Fed found that nearly 34 percent of project-based Section 8 units and 20 percent of all subsidized units in Philadelphia will approach the end of their affordability restrictions by 2020.

Figure 2: Units Where Project-Based Section 8 Contract Expired in Philadelphia, 2000 to 2010

Source: Based on data from the U.S. Department of Housing and Urban Development and those employed in Michael C. Lens and Vincent Reina, “Preserving Neighborhood Opportunity: Where Federal Housing Subsidies Expire,” Housing Policy Debate 26:4–5 (2016), pp. 714–732; available at http://www.tandfonline.com/doi/pdf/10.1080/10511482.2016.1195422.

Lens and Reina (2016) find that, nationally, properties that exited the project-based Section 8 program between 2000 and 2010 were generally located in neighborhoods that offered fewer opportunities but that these neighborhoods also showed the strongest improvements during that period. In other words, these are neighborhoods that may have been largely affordable at the time but were on the path to becoming unaffordable. This reinforces previous findings6 that private owners are reacting to neighborhood change dynamics when deciding to exit subsidy programs.

Moreover, nationally, the project-based Section 8 units that are set to expire between 2011 and 2020 are in particularly high-opportunity neighborhoods. These are also neighborhoods that are higher opportunity7 than those where properties subsidized through other national housing programs are located, including new and existing LIHTC units and those leased with a voucher. While property owners will have the option to renew their subsidies, the research cited suggests that these properties are located in the areas where owners are shown to have higher odds of opting out.

The next question becomes then, what happens to tenants when an owner exits the project-based Section 8 program? Households in these properties are offered a voucher as a safety net when the subsidy contract ends but little is known about what happens to these households, including whether they use their voucher. In my dissertation,8 I studied this phenomenon and used HUD tenant-level data to track all households who ever lived in a property where the Section 8 subsidy expired. I found that fewer than 50 percent of households actually used the voucher they were entitled to when their property owner exited the project-based Section 8 program.

In Philadelphia, the share of voucher users is slightly over 50 percent, while in places like Newark, it is closer to 40 percent. Nationally, those who did not use their vouchers lost more than $400 per month of rental assistance on average, or roughly 41 percent of their effective income. More than half the households who use their vouchers move once or more and, on the whole, the destination neighborhoods have lower poverty levels than the origin neighborhoods. In aggregate, these findings highlight a worrisome reality, which is that an owner’s decision to exit the project-based Section 8 program results in a serious income shock for a large share of the low-income households in these properties. However, for the fraction of households in these properties who use their vouchers, this event could improve their well-being because their subsidy is now mobile and they can — and often do — use a voucher to move to a neighborhood with a slightly lower poverty level.

In sum, market-rate rental housing has become less affordable over the previous decade. At the same time that the demand for subsidized rental housing has increased, owners of existing subsidized properties are becoming eligible to exit these programs. Understanding where and when subsidies will expire is important as cities attempt to address issues of affordability in the rental market because they are often faced with the decision about whether to target existing resources toward the development of new affordable units or toward the preservation of existing ones. This research highlights that policymakers should account for multiple factors in making allocation decisions. First, they should consider what the expiration of a subsidy contract means for neighborhood access, if promoting access to opportunity neighborhoods is a goal. When looking at neighborhood access, policymakers should also consider existing conditions and change over time because properties may be located in what appear to be neighborhoods with fewer opportunities, but these neighborhoods may be improving dramatically. Second, policymakers should account for the impact that a subsidy expiration has on the well-being and future outcomes of households in these properties when deciding whether or which resources are allocated to preserve a property. In particular, local governments should ensure that households do not suffer a significant and immediate income shock if their property owner exits a subsidy program. Ultimately, resources like the affordability website at the Philadelphia Fed9 and the National Housing Preservation Database10 are important tools that should be employed and bolstered so policymakers can make such informed decisions.

The views expressed here do not necessarily represent the views of the Federal Reserve Bank of Philadelphia or the Federal Reserve System.

[1]Heather L. Schwartz, Raphael W. Bostic, Richard K. Green, Vincent J. Reina, Lois M. Davis, and Catherine H. Augustine, Preservation of Affordable Rental Housing: Evaluation of the MacArthur Foundation’s Window of Opportunity Initiative, Santa Monica, CA: Rand Corporation, 2016; available at www.rand.org/pubs/research_reports/RR1444.html.

[2]Based on Public Use Microdata Sample (PUMS) data used in Heather L. Schwartz, Raphael W. Bostic, Richard K. Green, Vincent J. Reina, Lois M. Davis, and Catherine H. Augustine, Preservation of Affordable Rental Housing: Evaluation of the MacArthur Foundation’s Window of Opportunity Initiative.

[3]Seth Chizeck, “Gentrification and Changes in the Stock of Low-Cost Rental Housing in Philadelphia, 2000 to 2014," Cascade Focus (January 2017). To examine trends in rental housing affordability in Pennsylvania, New Jersey, and Delaware from 2005 to 2014, see the Federal Reserve Bank of Philadelphia’s Rental Housing Affordability Data Tool.

[4]Vincent Reina and Michael Williams, “The Importance of Using Layered Data to Analyze Housing: The Case of the Subsidized Housing Information Project,” Cityscape 14:1 (2012), pp. 215–222; available at www.huduser.gov/portal/periodicals/cityscpe/vol14num1/Cityscape_Mar2012_imp_layereddata.pdf.

[5]Based on data from the U.S. Department of Housing and Urban Development and data used in Michael C. Lens and Vincent Reina, “Preserving Neighborhood Opportunity: Where Federal Housing Subsidies Expire,” Housing Policy Debate 26:4–5 (2016), pp. 714–732; available at http://www.tandfonline.com/doi/pdf/10.1080/10511482.2016.1195422.

[6]Vincent Reina and Jaclene Begley, “Will They Stay or Will They Go: Predicting Subsidized Housing Opt-Outs.” Journal of Housing Economics 23:1 (2014), pp. 1–16.

[7]In this paper, we use a range of neighborhood characteristics including rent levels, poverty rates, crime rates, school quality, education levels, and transportation costs, amongst others, to develop different neighborhood opportunity measures.

[8]Vincent Reina, “The Impact of Mobility and Government Rental Subsidies on the Welfare of Households and Affordability of Markets,” Doctoral Dissertation, University of Southern California (2016); available at http://digitallibrary.usc.edu/cdm/compoundobject/collection/p15799coll40/id/281192/rec/1.

[9]This tool can be accessed here.

[10]This tool can be accessed at www.preservationdatabase.org.