When Maurice Hallett retired from corporate America seven years ago, his mission was simple: to barbecue. He and his brother Reggie Hallett secured a spot along Trenton’s Front Street and set their sights on the biggest smoker they could find — “Boss Hog,” as they now affectionately call it. In 2015, the duo opened 1911 Smoke House Barbeque and quickly began to amass a following of locals, nearby state office workers, and with Philadelphia just a short train ride away, barbecue lovers willing to travel for a succulent smothered rib. Business was booming — until COVID-19 hit. Then, “it was ghost town,” Maurice recalled.

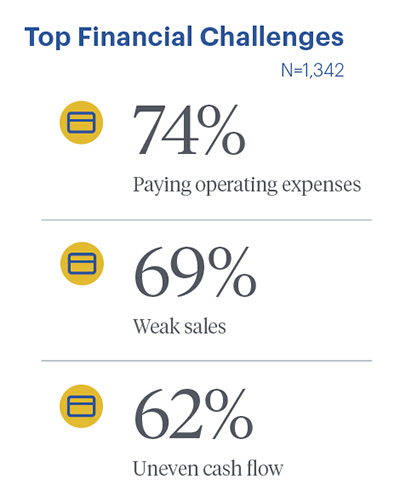

1911 Smoke House Barbeque is just one of the more than 930,000 small businesses in New Jersey that employ almost half of the state’s workforce. But two years into the pandemic, Maurice’s story is all too familiar among small business owners. The pandemic shutdowns and lost revenue hit these local businesses hard, and many had very different experiences with applying for (and receiving) support during the recovery. Small businesses owned by people of color faced significant barriers in securing emergency credit and loans. Some did not even apply. Firms participating in the Fed’s 2020 Small Business Credit Survey revealed that less than half (42 percent) of Black-owned firms received all the Paycheck Protection Program (PPP) funding they sought, and more than one in five Latino-owned firms said that they received no PPP funding at all. This created significant disparities in financial conditions and affected some small business owners’ ability to recover. Of more than 1,350 New Jersey firms participating in the Fed’s 2021 survey, almost three-quarters reported that they have not recovered to their pre-pandemic revenue and nearly the same number said they are struggling just to meet their operating expenses.

Trenton. She spoke with Philadelphia Fed President Patrick

Harker during a visit on August 2, 2022.

Paula Taylor, owner of Arlee’s Raw Blends, said that without additional resources, her business may not have survived the pandemic. She and her “juice mixologist” brother opened a third location of their business on Warren Steet in Trenton in 2019, and “things were just starting take off,” she said. Then, her main customers, the office workers on State Street, disappeared. She knew she needed assistance to supplement her personal savings, and she applied for the second round of federal CARES Act funding, specifically focused on supporting small business. Paula was able to access an emergency assistance grant through the New Jersey Economic Development Authority (NJEDA) and participate in the state’s Small Business Lease Assistance Program, both of which helped with paying rent and keeping just a handful of workers on the payroll. While she is grateful for the support, she’s also anxious to fully recover and put more local workers back on the job. “I probably could really use anywhere from about eight to 10 employees, just for here,” Paula noted. And longer term, she wants to grow. She hopes to one day secure a warehouse for storage and space to create more healthy food options, which she points outs means more jobs for local residents. “I’m committed to Trenton, and I’ll do whatever I can to keep my store here,” Paula emphasized. “I grew up in the inner city. So, I know the need for real food, good food, wholesome food.”

Partnerships Are Key

Since the onset of the pandemic, the Philadelphia Fed, the NJEDA, and other public agencies, nonprofits, and groups have been working together to help small businesses in New Jersey — especially those owned by people of color — break down the barriers to a full recovery, including accessing credit and capital and building stronger relationships with local lenders. With the goal of leveraging research, innovation, and partnership to spur action, this ongoing Research In Action Lab has included roundtables with bankers, surveys, focus groups with New Jersey small businesses, and regular convenings with stakeholders across sectors and industries. Additionally, New Jersey recently announced a $50 million Main Street Recovery program in the 2023 budget to help small businesses transition from pandemic to recovery, focusing their efforts on equity and inclusion, particularly for minority-, women-, LGBTQ-, and veteran-owned businesses.

At an August 2 roundtable cohosted by the Philadelphia Fed and NJEDA in Trenton, several city business owners shared their experiences navigating the pandemic, recovery, and now, the increased costs of inflation. Leaders from the Philadelphia Fed, including President and CEO Patrick Harker, Senior Vice President and Lending Officer Bill Spaniel, and Economic Growth & Mobility Project Director Ashley Putnam, who leads the Philadelphia Fed’s Research in Action Lab series, participated. Joining them were city and state representatives from the NJEDA, the Trenton Division of Economic Development, and the city’s Housing & Economic Development Department. Other partnering organizations, including the African American Chamber of Commerce of New Jersey, New Jersey Community Capital, and the New Jersey Small Business Development Center at the College of New Jersey, also joined in the discussion.

Each of the owners brought a unique perspective to the discussion — from launching a new business during the pandemic to keeping their workers employed and safe during the pandemic — but collectively they agreed: No one has fully recovered. Support is still needed.

Some owners mentioned that knowing where to turn for assistance beyond large banks — and predatory lenders — is essential. A prime example is community development financial institutions (CDFIs). Christina Fuentes, managing director of the NJEDA, emphasized how business education is vital in helping businesses not only recover now but also sustain themselves in the future.

That’s the benefit of CDFIs and why we support them so much,” said Christina. “It’s not about just the access to capital, it’s about the technical assistance behind that, too — like how do you support your payroll to sustain yourself without consistently [overextending] your credit cards?

Christina Fuentes

Christina Fuentes

Managing Director, NJEDA

Service, Inc., serving the Trenton

community.

Kym Williams, owner of Kelly’s Janitorial Service Inc., shared that during the pandemic her main focus was keeping her workers safe and employed. She said that much of the NJEDA grant and Paycheck Protection Program funding Kelly’s received were used to secure scarce supplies and—at the time, very expensive personal protection equipment—for her staff. Now, she says, her emphasis is on diversifying and expanding her services. “Kelly’s was already offering specialized services before the pandemic,” Kym noted. “Now, with the increase in remote work and reductions in our standard cleaning contracts, we’re looking to leverage more capital to grow our business in different ways and also reach new customers.”

John Harmon, founder, president, and CEO of the African American Chamber of Commerce of New Jersey, pointed to the value of partnerships in connecting small business owners — particularly Black and Hispanic owners — to the resources available to them. “Finding a good strategic partner to be a mediator in that relationship, that’s what we’re positioning ourselves to do,” he said. In July, the NJEDA announced a partnership with the African American Chamber of Commerce and the Statewide Hispanic Chamber of Commerce and $1 million in funding for the Small Business Bonding Readiness program, which will provide courses and training to better position small businesses to qualify for surety bonding and more competitively bid on public works projects.

Looking Forward

Trenton, New Jersey during the

pandemic.

Evan Harris started his business, a formalwear shop along Broad Street, at the height of the pandemic. After being laid off from his sales job at a menswear chain store, he leveraged his experience and styling talents to bring a much-needed local men’s clothing shop to Trenton. In March 2022, BeSuited celebrated its one-year anniversary. Evan can’t help but feel that the only way forward from here is up. “Getting through the long turnaround times, which is always my biggest concern, and the supply chain issues; it's actually pretty good right now, honestly,” said Evan. “I feel like I've already experienced the worst of it.”

LLC based in Trenton, New Jersey.

Marino Posso, owner of Advertise It, LLC, agreed. “There’s resilience and stick-to-itiveness among small business here wanting to be part of the fabric of the American dream,” he shared. “Despite COVID-19 and everything else, [business owners] have been innovative and found ways to keep their doors open. We know we have some obstacles, but despite those things, we’ve had a whole lot of wins.”

For President Harker and Philadelphia Fed staff, this conversation added important insights to what a day spent touring the local small business community showed.

“Up and down the state, and really across our whole District, we find people who have incredible resilience,” President Harker remarked. “Research may be one aspect of our work to support the economy, but conversations like these help us to better understand the barriers holding back small business recovery. The people behind small businesses are the heart of a strong local economy. And that's what we need to focus on when we consider economic policy.”

- The views expressed here are solely those of the author and do not necessarily reflect the views of the Federal Reserve Bank of Philadelphia or the Federal Reserve System.