For immediate release

Contact: Kelly Antonacci, Media Relations

Philadelphia, PA – Deteriorating credit card performance, declining mortgage originations, and housing affordability issues marked the end of 2023, according to the Federal Reserve Bank of Philadelphia’s latest Large Bank Credit Card and Mortgage Data.

The Q4 2023 data are accompanied by a new interactive dashboard that makes it easier to analyze trends over time.

Q4 2023 Insights

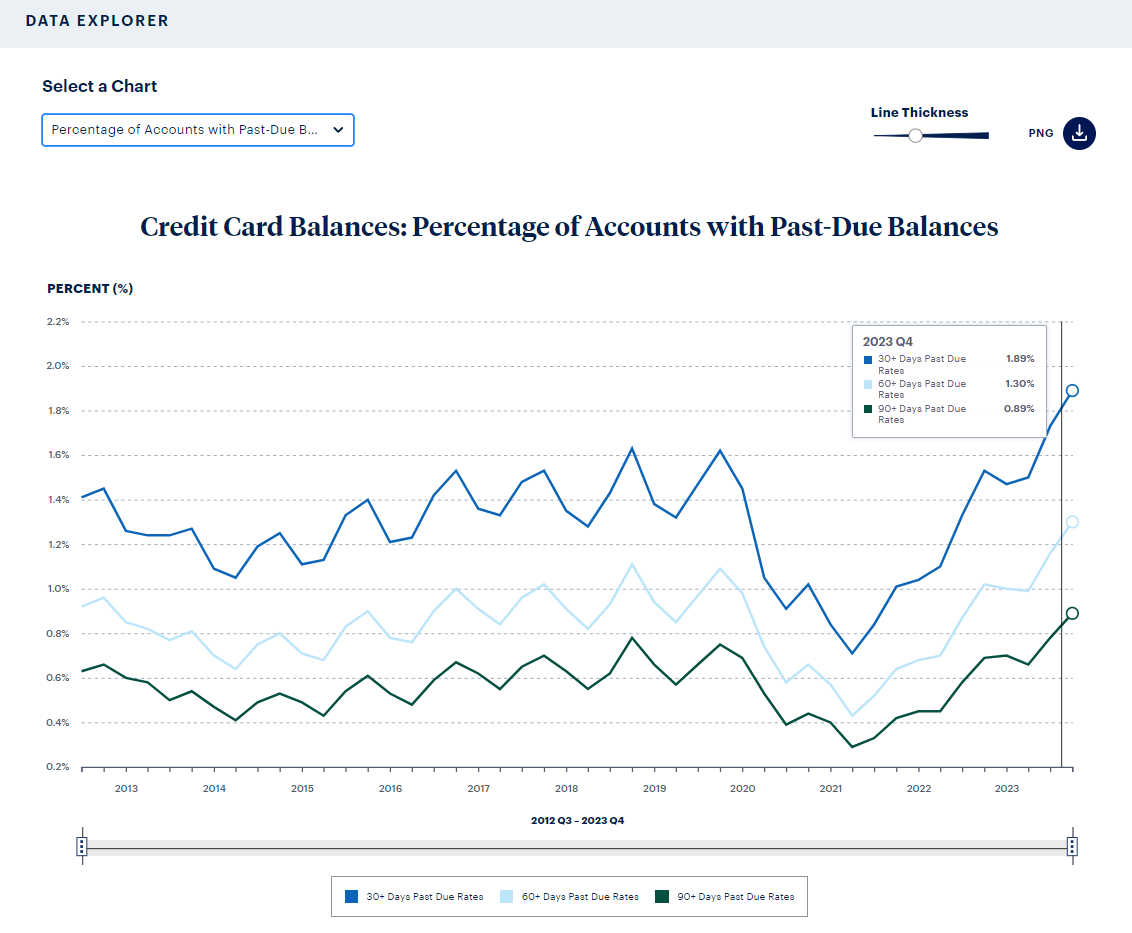

Several Q4 2023 measures surpassed records set since the series began in Q3 2012.

- Credit card delinquency rates worsened to series highs. More credit card accounts were 30+ and 60+ days past due in Q4 2023 compared with any other quarter since 2012.

- Mortgage originations dropped to a series low. The 30+ days past due rate increased quarter over quarter, but delinquencies are hovering near series lows and remain well below pre-pandemic levels.

- The median front-end debt-to-income (DTI) ratio rose to a series high. Median origination loan size and loan-to-value (LTV) increased 9.3 percent and 900 basis points, respectively, above Q4 2021 levels. Combined, the increases underscore continued affordability issues as housing costs consume a larger share of borrowers’ budgets.

The interactive dashboard lets users drill down into 32 different data charts. Charts include information on credit card balances and originations and first-lien mortgage balances and originations from when the series began in Q3 2012 to the present. The Philadelphia Fed today published an article about how these data can provide insights into large banks and consumer trends.

About Large Bank Credit Card and Mortgage Data

Credit card data are largely reflective of the total U.S. credit card market, representing roughly four-fifths of total U.S. bank card balances. Mortgage data represent roughly one-eighth of the U.S. residential mortgage market.

Large Bank Credit Card and Mortgage Data are gathered quarterly from Federal Reserve Y-14M data collected by U.S. bank holding companies, U.S. intermediate holding companies of foreign banking organizations, and covered savings and loan holding companies with $100 billion or more in total consolidated assets.

The Philadelphia Fed publicized the regulatory data in mid-2022 to share consumer credit data with the general public and provide an increased level of clarity on large bank consumer trends.

About the Federal Reserve Bank of Philadelphia

The Federal Reserve Bank of Philadelphia helps formulate and implement monetary policy; supervises state member banks, bank holding companies, and savings and loan holding companies; and provides financial services to depository institutions and the federal government. It is one of the 12 regional Reserve Banks that, together with the Board of Governors in Washington, D.C., make up the Federal Reserve System. The Federal Reserve Bank of Philadelphia serves eastern and central Pennsylvania, southern New Jersey, and Delaware.