For immediate release

Contact: Daneil Mazone, Media Relations, 215-574-7163

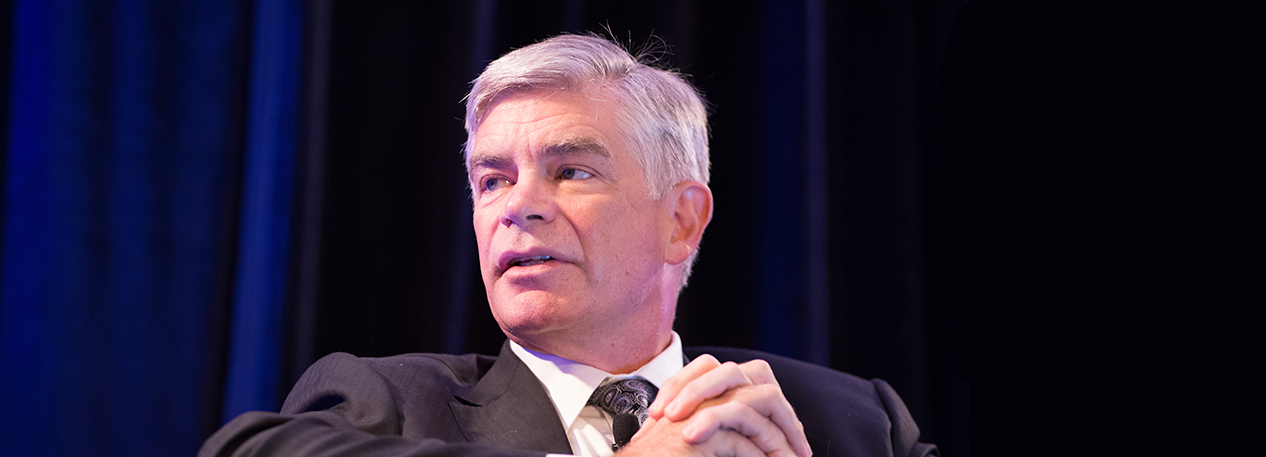

Tokyo, Japan — “Removing accommodation is the right next step for a few reasons,” said Philadelphia Fed President Patrick T. Harker during an address in Tokyo. “Monetary policy in the United States has been very accommodative for close to a decade,” he said, and while acknowledging that he is still keeping a watchful eye on inflation, the “economy now is more or less at full strength.”

He said unwinding the balance sheet “is also about keeping our powder dry. In the event of another shock to the system, I want our tools to be at their most effective and, in my view, that means reducing our balance sheet.”

Harker stressed, as he has in the past, that the process itself will be like “watching paint dry,” but other countries not as far along in the normalization process could benefit from the lessons learned by the U.S., both with regard to the balance sheet and from the moment of liftoff. “One of the most important is that, in the normalization process, it’s possible to manage the balance sheet and rates separately, albeit with limits.”

“When we ended QE in late 2014, serious questions were posed about the feasibility of raising rates, given the size of the balance sheet. Traditionally, the New York Fed’s markets units that implement the policy — which we refer to simply as “the Desk” — implemented rate increases by making reserves scarce in the fed funds market. But more than $2 trillion of reserves rendered them anything but scarce.”

The situation necessitated a great deal of research and analysis, which “engineered a successful liftoff in December 2015. Rates have been under control since and remain well connected to other money markets.”

Harker noted, however, that the U.S. system was different than many other central banks’, comparing the classic model of a “corridor system” in which interest on reserves provides the floor. “In the U.S., however, not all institutions qualify to earn interest on reserves. With reserve markets satiated, it is therefore the reverse repos — available to a wider range of additional institutions — that provide a firm floor on market rates and the interest on reserves provides a cap.” He also credited Philadelphia Fed economists’ research, which “correctly predicted that most fed funds trades would occur at rates safely in the middle of the target range, even if actual use of reverse repos is quite low.”

“As our balance sheet declines, so does the supply of reserves. Eventually, reserves could become scarce again, which would, theoretically, make it possible to return to a classic corridor system, in which interest on reserves operates as a firm floor on market rates. Exactly what level of reserves would enable that is a topic of ongoing research. That level could be substantially larger than the last time we conducted policy in a reserves-scarce environment, owing to how much has changed since 2008. I will therefore continue to monitor this issue as the balance sheet shrinks.”