For immediate release

Contact: Daneil Mazone, Media Relations Representative, 215-574-7163

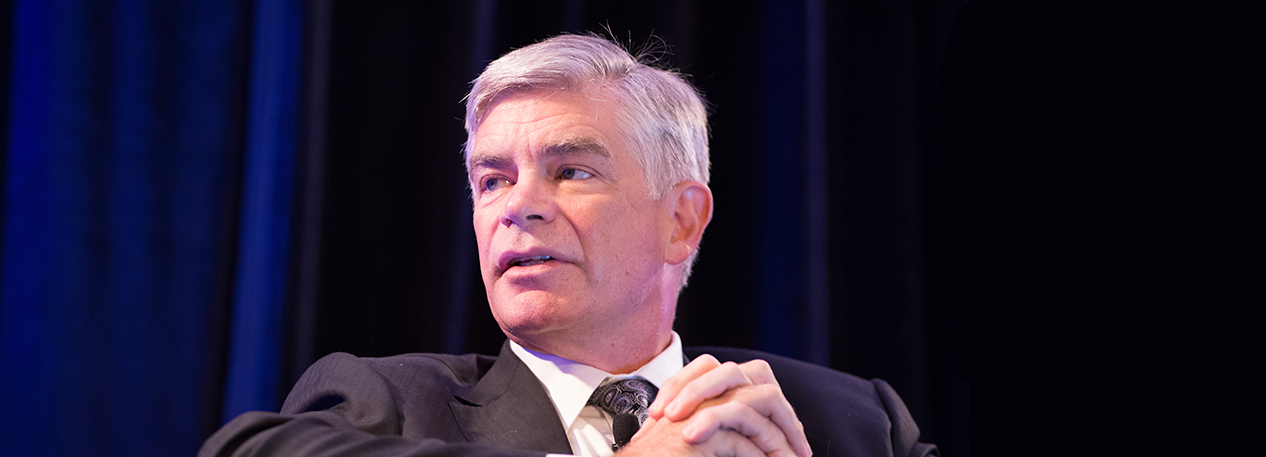

Philadelphia, PA — A slow and steady approach to unwinding the Fed’s balance sheet is Patrick T. Harker’s preference, the Philadelphia Fed president told a conference audience today.

The Federal Reserve has been in the process of reducing the size of its balance sheet since 2017 and announced further updates after the FOMC’s January and March meetings, saying it plans to continue to implement monetary policy “in a regime of ample reserves,” stop its asset-redemption program this September, and keep the size of the balance sheet constant for some time after that, while allowing the supply of reserves to gradually decline as currency and other non-reserve liabilities grow.

At that point, Harker said, reserve levels will likely be slightly higher than strictly necessary, a precaution he considers prudent.

“For me, a key issue is that we only have estimates of the demand for reserves, and that uncertainty calls for a cautious approach. It may be that ‘ample’ is more than we thought, and reserve levels can’t really drop much further without inflicting interest rate volatility and creating liquidity-management issues for financial institutions.”

He added that, “Additionally, the supply of reserves is notoriously volatile” and “autonomous factors can … inflict a substantial fluctuation in the supply of reserves to depository institutions.”

For that reason, he said, caution is necessary. “So in metaphorical terms, it is a dark and stormy night, to quote Peanuts, and we are walking in the direction of a wall. In that situation, most of us would give the advice of ‘walk, don’t run,’ and keep a bit of distance from where we think the wall is.”

Harker also addressed the composition of the balance sheet as normalization proceeds, noting that, “Once the balance sheet’s holdings do not exceed the need, they’re unlikely to meet the want — at least not that of the long run. The FOMC has made clear that the portfolio will consist primarily of Treasuries, but currently, MBS account for more than 40 percent.”