During an exercise on jobs at a Money Matters for Kids teacher training, an educator from Delaware raised her hand.

“All these job descriptions are great,” she said. “But how can I get my students thinking beyond becoming an influencer?”

It was a common challenge, the other teachers nodded in reply. But also, a question that a digital literacy educator in Philadelphia has encountered before.

The teacher spoke up with advice for other educators in the room, pointing out several jobs that may not be readily apparent for a short clip on TikTok, but are nonetheless important, she noted.

She went on to describe the behind-the-scenes jobs like videographers, editors, graphic designers, writers, and producers, who may be part of an influencers’ team, but may not be the jobs that students think about when they scroll through social media.

Taking Economics into the Classroom

Over the summer, nearly 200 educators took part in the Philadelphia Fed’s teacher trainings. Topics included personal financial education for elementary and middle school students, lessons on history and economics and behavioral economics for middle and high schoolers, as well as the Bank’s signature Keys to Financial Success program. A record 56 teachers joined this year’s Keys to Financial Success Teacher Training.

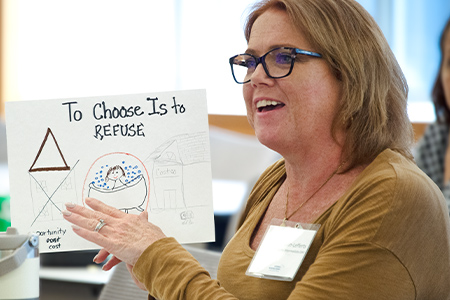

relaxation time over visiting the store as part of an

exercise on opportunity costs.

The courses are hosted by the Bank’s Economic Education team as a way to equip teachers with ideas, lessons, teaching methods, and classroom resources for incorporating economic concepts into their curriculum. The Keys to Financial Success program provides high school educators with a comprehensive plan for a semester-long personal finance course.

Throughout the day, teachers worked together on the exercises and lessons presented, similar to how their students might interact in the classroom. Collaborative learning is a key theme of all of the Philadelphia Fed’s Economic Education curriculum and courses, which has wide-ranging benefits for students. According to the National Education Association, group work enhances students’ critical thinking skills and self-confidence, as well as their social, interpersonal, and leadership abilities by exposing them to different learning styles and teamwork experiences.

This hands-on approach also gave the teachers a chance to discuss some of the broad challenges they face in meeting the needs of students from all different backgrounds in today’s ever-changing economy. Most agreed that equipping students with the skills and knowledge to understand how their everyday economic decisions impact their lives — now and in the future — was a top priority.

Understanding Everyday Economic Decisions, the Fed’s Role

different functions of the Fed.

Several teachers had deeper questions in mind too.

“Like what exactly does the Federal Reserve do?” a teacher posed during a break.

“The Fed has a lot of jobs,” said Todd Zartman, economic education manager. “Chief among them is monetary policy, or the federal funds rate that is most often talked about. But the Fed also supervises banks, facilitates payments, conducts research and community outreach, and of course, develops educational resources on economic and financial topics, like today’s training.”

Consumer protection and education are among five functions that the Federal Reserve carries out to promote the health and stability of the nation’s economy and financial system.

“Each Reserve Bank also has an important job in representing the communities and understanding the unique local economies they serve within their District,” Zartman explained.

Lessons to Build On

lesson during the Money Matters training.

A key takeaway for many of the teachers was the importance of just getting started.

In recent years, many states, including Delaware, New Jersey, and Pennsylvania, have adopted academic standards for teaching personal financial education and basic economics in their school districts.

“Starting early is something we hope every school district will do,” said Andrew Hill, assistant vice president, Economic Education. “We offer both curriculum resources and training to help educators teach personal finance in the elementary and middle grades, as well as high school.”