The research discussed in this CFI in Focus article provides background on secured credit cards, their users, and the path to secured card graduation.

An estimated 26 million Americans are “credit invisible,” meaning they do not have any credit record with the national credit reporting agencies; another 19 million are considered “unscoreable” because of insufficient or old information. This population usually has little access to mainstream lending products. Secured cards are a useful tool for these borrowers.

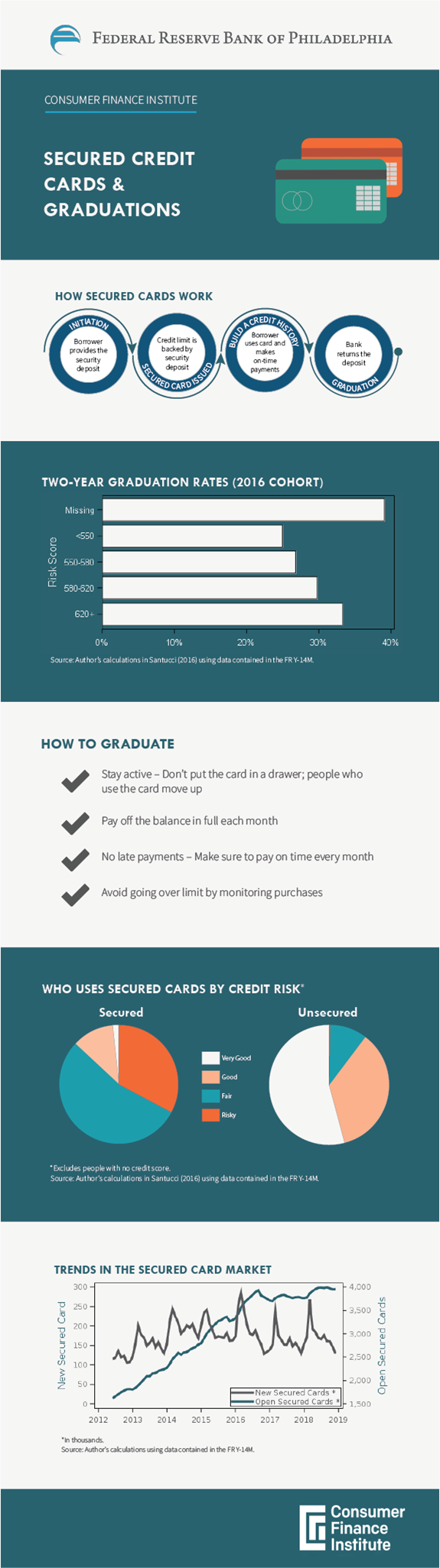

Secured cards differ from unsecured credit cards in that they require borrowers to make a deposit with the lender that serves as collateral for the account. Similar to its unsecured counterpart, secured cards allow consumers to establish and build a record of credit use and, as a result, offer them an opportunity to eventually access more traditional lending products, including unsecured credit cards, as well as auto and other installment loans.

Recent research done at the Philadelphia Fed highlights some trends within the secured card space.

When borrowers have a credit score, secured card users tend to be in the lower-credit score (higher-risk) groups, and unsecured borrowers tend to be in the higher-credit score (lower-risk) groups. Furthermore, about half of new secured card borrowers lack a credit score at the time of origination.

Once a borrower has established a history of on-time payments, a lender may choose to “graduate” the secured card account to an unsecured account by refunding the deposit. Graduation represents a significant milestone on a borrower’s credit journey because it signals that the individual is eligible for mainstream credit products.

Fed research indicates that graduation is not only becoming more common but is also happening earlier in the life of the account with each successive cohort. One explanation of this trend of earlier graduations may be that lenders are attempting to retain their more promising secured card customers before they are “poached” by other lenders. Or this may simply reflect the gradual loosening over time of what were very tight credit standards during the Great Recession.

The views reflected in this report represent those of the author and not necessarily those of the Federal Reserve Bank of Philadelphia or the Federal Reserve System.

View the Full Article