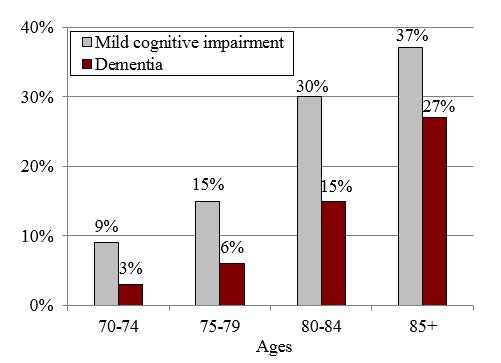

The world faces a demographic time bomb: the aging of the baby boom generation — people born between 1946 and 1964 — into their retirement years. The U.S. Census Bureau projects the U.S. will have approximately 72.3 million people aged 65 years and older in 2030 and almost 84 million that age by 2050. Since the prevalence of mild cognitive impairment (MCI) and dementia increases with age, the expected rise in the number of older Americans means the U.S. will face an increase in MCI and dementia cases.

This CFI in Focus examines the link between changes in cognition, diminished financial capacity (the progressive loss of the ability to manage banking and investment decisions), and elder victimization, with a focus on how the financial services industry can help improve the financial well-being of older adults.

Researchers at the Philadelphia Fed have partnered with the financial services sector to investigate existing safeguards for older, vulnerable adults and to evaluate new ways to prevent elder fraud and financial exploitation. This work includes in-depth research, a 2017 conference on mental cognition and financial health, and public comments by Philadelphia Fed President Patrick T. Harker. These events are discussed in detail in this CFI in Focus. Future events and research are also planned.

Figure 1. Incidence of Cognitive Impairment and Dementia, By Age

Source: Geoffrey Sanzenbacher’s calculations, based on data from the University of Michigan, Health and Retirement Study (1994–2014).

Belbase and Sanzenbacher, “Cognitive Aging and the Capacity to Manage Money.”

The views reflected in this article do not represent those of the Federal Reserve Bank of Philadelphia.