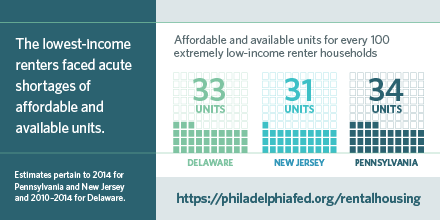

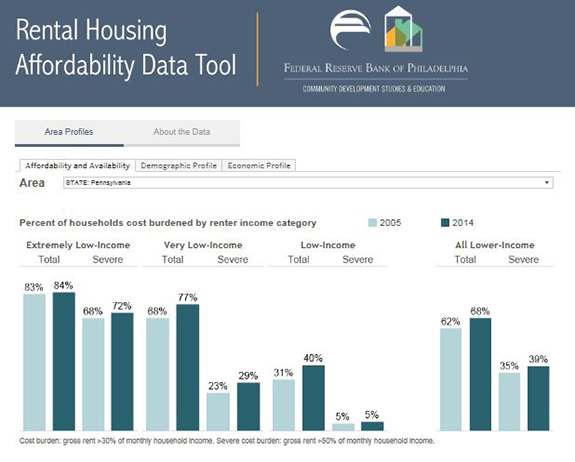

Across Delaware, New Jersey, and Pennsylvania, the lowest-income renters faced severe shortages of affordable and available units (Figure 1) in 2014, leading to widespread housing cost burdens among households with the most limited means. In all three states, the share of lower-income renter households with unaffordable housing costs1 grew significantly from 2005 to 2014, ranging from over two-thirds in Pennsylvania to more than three-quarters in New Jersey in the most recent estimates.2

Figure 1

The drivers of growing rental affordability challenges are well documented. The spike in home foreclosures that began in 2008 pushed many low-income former homeowners into the rental market,3 while many would-be homeowners have been impeded by tightened mortgage standards and growing student loan debt levels.4 Nationally, this increased demand for rental housing has yielded some of the lowest rental vacancy rates in more than 20 years,5 putting upward pressure on rents. These trends have intensified a longstanding issue for the poorest renters, who simply do not have sufficient income to rent a unit at market rate. In addition, only one in four of these low-income renters has access to needed housing subsidies.6

Rental Housing Affordability Data Tool

To provide communities in Delaware, New Jersey, and Pennsylvania with a more comprehensive understanding of the households that struggle to afford housing, the Community Development Studies & Education (CDS&E) Department has released the Rental Housing Affordability Data Tool. This interactive tool enables users to examine trends in rental housing affordability in Delaware, New Jersey, and Pennsylvania from 2005 to 2014.

In addition to information on the affordability of the rental stock, the tool presents demographic and economic profiles of the renter households facing unaffordable housing costs, available for the three states and a number of metropolitan regions. This information can be used to help identify vulnerable groups and inform comprehensive approaches to addressing the challenges facing low-income renters.

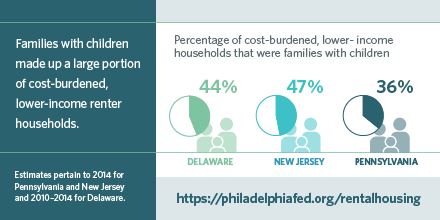

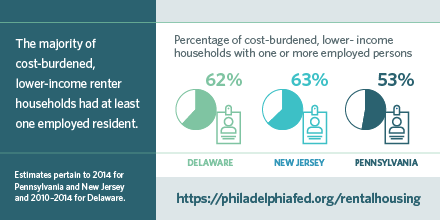

The impact of unaffordable housing reaches beyond the immediate demands on household budgets. Given the central role that housing plays in our lives, affordability issues interact with a wide range of community and economic development concerns. Two key findings from the Rental Housing Affordability Data Tool illustrate this point. First, in nearly every community in our region, families with children make up a substantial portion of cost-burdened, lower-income renter households. The family budgetary tradeoffs and the elevated risk of residential instability that this entails can have substantial negative effects on children’s development. Second, while the majority of cost-burdened, lower-income renter households in the three states had at least one employed resident in 2014, it is clear that many working-age adults in these households face substantial barriers to gainful employment. The challenges associated with finding affordable units can undermine their efforts toward economic stability.

Families with Children

In each of the three states (Figure 2) and nearly every metropolitan region, families with children made up more than one-third of the cost-burdened, lower-income households in 2014. In the Atlantic City–Hammonton, Dover, and East Stroudsburg metropolitan areas, the portion was roughly half (50 percent, 50 percent, and 51 percent, respectively, from 2010 to 2014). Affordability challenges were especially prevalent for single parents: Across the three states, roughly 60 percent of households at any income level headed by single parents were cost burdened.

Figure 2

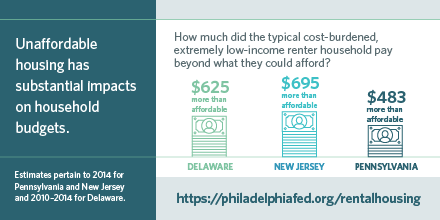

While burdensome housing costs can be challenging for any household, the associated financial strain confronts low-income families with a particularly difficult set of tradeoffs. On the one hand, the most direct impact of unaffordable housing costs is diminished resources left over for other needs, as illustrated by Figure 3. Recent research suggests that low-income families with high housing cost burdens spend less on enrichment activities for their children, potentially contributing to worse cognitive outcomes.7 However, if accessing affordable rental housing comes at the expense of serious housing quality issues or overcrowding, or if affordable units are located in areas with high rates of violent crime and low performing schools, poor outcomes for children are even more likely.8 Of course, the poorest families with the greatest budgetary constraints have the fewest options for making tradeoffs that would maximize child well-being.

Figure 3

Furthermore, for families at the lowest end of the income scale, unaffordable rents paired with income volatility can lead to residential instability, causing major interruptions in children’s lives. The Joint Center for Housing Studies of Harvard University estimates that, nationally, roughly 2 million low-income renter households were at risk of eviction in 2013.9 Analysis of eviction patterns in Philadelphia reveals a disproportionate likelihood of such destabilizing moves for residents of poor, predominantly black neighborhoods.10 Chronic residential instability increases parental stress and can negatively affect younger children’s vocabulary development, increase adolescents’ risk of dropping out of high school, and harm the mental health of youth of any age.11

Working-Age Adults

As illustrated in Figure 4, in Delaware, New Jersey, and Pennsylvania, the majority of cost-burdened, lower-income renter households had at least one employed resident in 2014.12 Looking at the prior year’s employment patterns of working-age adults13 in these households, it appears that roughly one-quarter of these adults may have been underemployed or experienced a recent job loss, working either part-time or full-time for only part of the year. Further, in these three states, only 31 percent to 42 percent of working-age adults in cost-burdened, lower-income renter households worked full-time for most of the prior year.

Figure 4

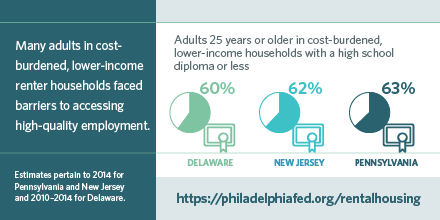

Elevated rates of unemployment and underemployment among adults in cost-burdened, lower-income households may in part be a function of the job opportunities available to them. In each of the three states, adults in these households were disproportionately likely to have a high school diploma or less as their highest level of education (Figure 5). The decline of decent-paying jobs available to workers with less than a four-year degree is well documented, particularly for those without any postsecondary training.14 Federal Reserve researchers have found that the availability of such jobs varies dramatically by region but generally declined from 2005 to 2014.15 For many of these individuals, job training or certificate programs may provide opportunities for upward mobility; however, in a recent survey of workforce development program administrators, nearly half of respondents identified housing assistance as a top unmet need for both male and female participants. Additionally, while 28 percent specifically identified unaffordable housing as a reason that participants did not complete training, 59 percent cited financial considerations,16 which include housing costs.

Figure 5

On the demand side of the employment equation, the location of affordable rental units can profoundly affect low-income renters’ access to job opportunities. Recent research published by CDS&E found that Philadelphia’s gentrifying neighborhoods lost low-cost rental units at nearly five times the rate of low-income neighborhoods that did not gentrify between 2000 and 2014.17 With 1.5 jobs per working-age resident in gentrifying neighborhoods from 2010 to 2014 compared with just 0.4 jobs in nongentrifying neighborhoods,18 this loss of low-cost rental units has substantially reduced low-income renters’ housing options in some of the most opportunity-rich neighborhoods in the city. Indeed, previous research on gentrification and residential mobility found that vulnerable residents who are unable to remain in Philadelphia’s gentrifying neighborhoods were considerably more likely to move to neighborhoods with higher unemployment rates.19

Conclusion

Clearly, the affordability, location, and stability of rental housing have significant implications for the well-being and human capital development opportunities of both youth and working-age adults.20 The challenges outlined in this article are stark, but existing research points to promising avenues for intervention. An analysis of families living in subsidized housing found that each year teenagers lived in assisted units increased their annual earnings as an adult and decreased the likelihood of incarceration for both males and females as compared with the outcomes of siblings who lived in non-assisted units for longer periods of time.21 For disadvantaged workers, access to needed housing supports may make the difference between completing job training programs that lead to upward mobility and falling short. Further, recent research suggests that enabling vulnerable renters to remain in gentrifying neighborhoods improves their employment outcomes.22 These and other positive externalities of ensuring that lower-income renters have access to decent-quality, affordable units in opportunity-rich neighborhoods should be kept in mind by community and economic development practitioners as they develop responses to the widespread challenge of rental housing unaffordability.

The views expressed here do not necessarily represent the views of the Federal Reserve Bank of Philadelphia or the Federal Reserve System.

[1]Lower-income refers to household income ≤ 80 percent of median family income in the associated region. Housing costs are considered unaffordable if gross rent exceeds 30 percent of monthly household income.

[2]Unless otherwise noted, estimates are from the Federal Reserve Bank of Philadelphia’s Rental Housing Affordability Data Tool, based on the U.S. Census Bureau’s American Community Survey (ACS) Public Use Microdata Sample (PUMS), accessed via the Minnesota Population Center IPUMS-USA database. For Delaware, here and throughout this article, the comparison periods are 2005–2009 and 2010–2014.

[3]“Chapter 1: Executive Summary,” in Joint Center for Housing Studies of Harvard University, The State of the Nation’s Housing 2016. Cambridge, MA: Harvard University, 2016; available at www.jchs.harvard.edu/research/state_nations_housing.

[4]On tightening mortgage standards, see Urban Institute, “Housing Credit Availability Index” for Q3 2016; available at www.urban.org/policy-centers/housing-finance-policy-center/projects/housing-credit-availability-index. On student loan debt and homeownership, see Alvaro A. Mezza, Daniel R. Ringo, Shane M. Sherlund, and Kamila Sommer, “On the Effect of Student Loans on Access to Homeownership,” Finance and Economics Discussion Series 2016-010, Board of Governors of the Federal Reserve System, 2016; available at www.federalreserve.gov/econresdata/feds/2016/files/2016010pap.pdf.

[5]U.S. Census Bureau, Current Population Survey/Housing Vacancy Survey, Series H-111, Table.

[6]“Chapter 1: Executive Summary,” in Joint Center for Housing Studies of Harvard University, The State of the Nation’s Housing 2016. Cambridge, MA: Harvard University, 2016; available at www.jchs.harvard.edu/research/state_nations_housing.

[7]Sandra J. Newman and C. Scott Holupka, “Housing Affordability and Investments in Children,” Journal of Housing Economics 24 (June 2014), pp. 89–100.

[8]See Tama Leventhal and Sandra Newman, “Housing and Child Development,” Children and Youth Services Review 32:9 (2010), pp. 1165–1174, and Claudia D. Solari and Robert D. Mare, “Housing Crowding Effects on Children’s Wellbeing,” Social Science Research 41:2 (2012), pp. 464–476.

[9]“Chapter 1: Executive Summary,” in Joint Center for Housing Studies of Harvard University, The State of the Nation’s Housing 2016. Cambridge, MA: Harvard University, 2016; available at www.jchs.harvard.edu/research/state_nations_housing.

[10]Ira Goldstein, Al Parker, and Rhea Acuña, “Policy Brief: Evictions in Philadelphia,” Reinvestment Fund, January 2017; available at www.reinvestment.com/wp-content/uploads/2017/01/Evictions_in_Philadelphia_brief_Final.pdf.

[11]Heather Sandstrom and Sandra Huerta, “The Negative Effects of Instability on Child Development,” Low-Income Working Families Fact Sheet, Urban Institute, September 2013; available at www.urban.org/sites/default/files/alfresco/publication-pdfs/412908-The-Negative-Effects-of-Instability-on-Child-Development-Fact-Sheet.pdf.

[12]Households headed by seniors and people with disabilities constitute a substantial share of households without employed residents.

[13]Defined as individuals 18 to 65 years old not enrolled in school.

[14]For a brief discussion, see David Autor, “The Polarization of Job Opportunities in the U.S. Labor Market: Implications for Employment and Earnings,” Federal Reserve Bank of San Francisco Community Investments 23:2 (Fall 2011), pp. 11–16; available at www.frbsf.org/community-development/files/CI_IncomeInequality_Autor.pdf.

[15]Keith Wardrip, Kyle Fee, Lisa Nelson, and Stuart Andreason, “Identifying Opportunity Occupations in the Nation’s Largest Metropolitan Economies,” Special Report, Federal Reserve Banks of Philadelphia, Cleveland, and Atlanta, 2015.

[16]Cynthia Hess, Emma Williams-Baron, Barbara Gault, and Ariane Hegewisch, “Supportive Services in Workforce Development Programs: Administrator Perspective on Availability and Unmet Needs,” Institute for Women’s Policy Research, December 2016; available at www.iwpr.org/publications/pubs/supportive-services-in-workforce-development-programs-administrator-perspectives-on-availability-and-unmet-needs.

[17]Seth Chizeck, “Gentrification and Changes in the Stock of Low-Cost Rental Housing in Philadelphia, 2000 to 2014,” Federal Reserve Bank of Philadelphia Cascade Focus (January 2017).

[18]Author’s calculation based on U.S. Census Bureau’s 2010 to 2014 American Community Survey Table B01001 and 2014 Longitudinal Employer–Household Dynamics data, accessed via PolicyMap (www.policymap.com).

[19]Lei Ding, Jackelyn Hwang, and Eileen Divringi, “Gentrification and Residential Mobility in Philadelphia,” Regional Science and Urban Economics 61 (2016), pp. 38–51.

[20]For brevity’s sake, this article does not review the existing literature on rental housing for seniors and people with disabilities. For a discussion of the topics, see the Joint Center for Housing Studies of Harvard University report, “Housing America’s Older Adults: Meeting the Needs of an Aging Population,” 2014; available at www.jchs.harvard.edu/research/housing_americas_older_adults, and Micaela Connery, “Disability Housing: What’s Happening? What’s Challenging? What’s Needed?” Joint Center for Housing Studies of Harvard University Working Paper, April 2016; available at www.jchs.harvard.edu/research/publications/disability-housing.

[21]Fredrik Andersson, John C. Haltiwanger, Mark J. Kutzbach, Giordano E. Palloni, Henry O. Pollakowski, and Daniel H. Weinberg, “Childhood Housing and Adult Earnings: A Between-Siblings Analysis of Housing Vouchers and Public Housing,” NBER Working Paper 22721, October 2016; available at www.nber.org/papers/w22721.pdf.

[22]Samuel Dastrup and Ingrid Gould Ellen, “Linking Residents to Opportunity: Gentrification and Public Housing,” Cityscape 18:3 (2016), pp. 87–107; available at www.huduser.gov/portal/periodicals/cityscpe/vol18num3/ch4.pdf.