What It’s Worth: Strengthening the Financial Future of Families, Communities and the Nation1 is a compilation of more than 30 essays that present new ideas for helping all Americans gain control over their financial lives and achieve their financial goals. As the book’s cover indicates, financial health and well-being form the bridge to a strong financial future, connecting individuals and families to greater opportunity, creating more vibrant communities, and, in turn, strengthening the social and economic fabric of our nation.

What It’s Worth is the third book in a series, following Investing in What Works for America’s Communities: Essays on People, Place & Purpose2 and What Counts: Harnessing Data for America’s Communities.3 Together, these books explore ideas for the future of community development, highlighting examples of integrated, cross-sector, data-driven approaches from across the country. What It’s Worth builds on these themes and takes a 360-degree view of the financial problems and challenges millions of American households face, the enormous creativity and innovation already happening to increase financial well-being, and ways to implement proven and emerging solutions. The book also makes clear that addressing these issues requires new partnerships across sectors such as health, education, criminal justice, and workforce development. No single sector or approach can do it alone.

Key Takeaways from What It’s Worth

1. A new understanding of financial health and well-being is emerging.

In the United States, we have traditionally defined financial status by income or wealth, but experts in policy and practice from a range of fields are expanding our focus to better understand what consumers want and need in their financial lives. For example, income and expenses are often unpredictable and mismatched.4 The traditional concept of a steady biweekly paycheck is becoming a thing of the past, and a significant share of households, even those with higher incomes, experience dramatic swings in their income and expenses. This variability can make it difficult to meet daily needs, plan for the future, and weather unexpected challenges.

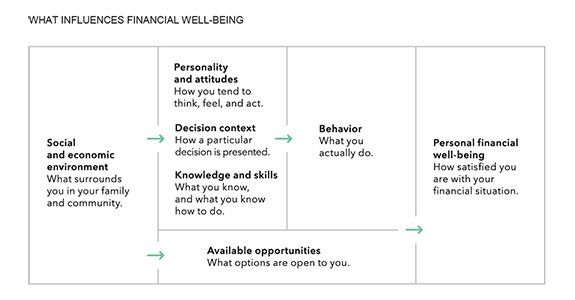

A consensus is emerging that satisfaction with one’s financial life has elements that are both objective (income, wealth, cash flow) and subjective (financial freedom, on track to meet financial goals). There is no official benchmark for “financial well-being,” but the Consumer Financial Protection Bureau (CFPB) defines the term as “financial security and financial freedom of choice in the present and in the future.”5 Financial well-being is determined by a complex array of circumstances and choices. For many people, factors beyond their control determine the financial choices they have. It’s important to recognize that the social and economic environment in which people grow up — including their parents’ education, when they are born and enter the job market, their race, where they live, or the schools they attend — may limit their opportunities to be financially healthy.

Source: Consumer Financial Protection Bureau, “Financial Well-Being: The Goal of Financial Education,” January 2015, p. 46, available at http://files.consumerfinance.gov/f/201501_cfpb_report_financial-well-being.pdf.

2. We must address the systems that influence financial well-being.

Creating financial health and well-being is not a just matter of changing individual behaviors. It also requires changing the systems that shape financial opportunities. Where we live, go to school, work each day, and receive health services — along with dozens of other daily actions — shape our financial health and well-being.

There are promising examples of integrated approaches in which new partners are building financial health into their existing approaches. For example, Delaware’s Department of Health and Social Services integrates financial coaching strategies6 into its efforts to promote health and self-sufficiency, and a private employer, Staples Inc., incorporates financial well-being into its suite of workplace benefits.7 What It’s Worth also reinforces the importance of place, noting that neighborhood quality plays a significant factor in housing stability, educational and employment opportunities, and health outcomes.

3. Everyone has a role to play in strengthening the financial future for all.

Individuals, families, and communities need to reach some threshold of financial well-being in order to achieve long-term goals such as boosting high school graduation rates, improving health, promoting more viable families, or developing better workers for 21st century jobs. Household financial well-being is an important intermediate step and organizing principle that allows different sectors to begin aligning their work. By starting to collectively recognize that financial well-being is often at the root of the myriad challenges that need to be solved over the long term, we can begin unifying around a common understanding of the next step forward. As stated in the book, “The beauty of household financial well-being as a conceptual framework is that it is both a stop on the road and a predictor of future success for so many other important outcomes.”8

Spreading the Message

In the coming year, the Federal Reserve Bank of San Francisco and CFED will partner with various Federal Reserve Banks across the System to hold regional events that will focus on local solutions and opportunities for building financial well-being. An upcoming event in partnership with the Federal Reserve Bank of Philadelphia on May 5, 2016, which will be held at the Philadelphia Fed, will explore the What It’s Worth book through the lens of health and income disparities. Researchers from both the public health and community development fields will present research demonstrating the potential to improve health outcomes by addressing nonmedical determinants of health such as financial stress and access to safe and affordable housing. Practitioners will share promising solutions for cross-sector collaboration aimed at improving the financial and physical health of families and communities.

In addition, we are excited to see that communities are using the book as a framework for establishing and strengthening their own financial well-being initiatives. For example, we’ve had requests to use What It’s Worth as part of strategic planning and staff and board training, as well as for use in college and graduate courses. The entire book is available for download without charge at www.strongfinancialfuture.org. Hard copies of What It’s Worth can be ordered also without charge at that site. We encourage you to explore the book, share it with your networks, and let us know how we can partner with you to build the financial future of your community.

For further information on the book, contact Laura Choi at laura.choi@sf.frb.org.

The views expressed here do not necessarily represent the views of the Federal Reserve Bank of Philadelphia or the Federal Reserve System.

[1]What It’s Worth: Strengthening the Financial Future of Families, Communities and the Nation. San Francisco/Washington, D.C.: Federal Reserve Bank of San Francisco and CFED, 2015, available at www.strongfinancialfuture.org/wp-content/uploads/2015/12/What-its-Worth_Full.pdf.

[2]Investing in What Works for America’s Communities: Essays on People, Place & Purpose. San Francisco: Federal Reserve Bank of San Francisco and Low Income Investment Fund, 2012, available at http://whatworksforamerica.org/pdf/whatworks_fullbook.pdf.

[3]What Counts: Harnessing Data for America’s Communities. San Francisco/Washington, D.C.: Federal Reserve Bank of San Francisco and the Urban Institute, 2014, available at www.whatcountsforamerica.org/wp-content/uploads/2014/12/WhatCounts.pdf.

[4]Jennifer Tescher and Rachel Schneider, “The Real Financial Lives of Americans,” in What It’s Worth: Strengthening the Financial Future of Families, Communities and the Nation. San Francisco/Washington, D.C.: Federal Reserve Bank of San Francisco and CFED, 2015, pp. 53–67, available at www.strongfinancialfuture.org/essays/the-real-financial-lives-of-americans/.

[5]Consumer Financial Protection Bureau, “Financial Well-Being: What it Means and How to Help,” January 2015, available at http://files.consumerfinance.gov/f/201501_cfpb_digest_financial-well-being.pdf.

[6]Rita Landgraf, “Treating Financial Well-Being as a Public Health Issue: Lessons from Delaware,” in What It’s Worth: Strengthening the Financial Future of Families, Communities and the Nation. San Francisco/Washington, D.C.: Federal Reserve Bank of San Francisco and CFED, 2015, pp. 173–178, available at www.strongfinancialfuture.org/essays/treating-financial-well-being-as-a-public-health-issue/.

[7]Regis Mulot, “Thinking Outside the 401(k): Employer-Sponsored Financial Health Solutions,” in What It’s Worth: Strengthening the Financial Future of Families, Communities and the Nation. San Francisco/Washington, D.C.: Federal Reserve Bank of San Francisco and CFED, 2015, pp. 143–147, available at www.strongfinancialfuture.org/essays/thinking-outside-the-401k/.

[8]Laura Choi and David Erickson, “Toward a New Business Model: Strengthening Families Helps to Strengthen Communities and the Nation,” in What It’s Worth: Strengthening the Financial Future of Families, Communities and the Nation. San Francisco/Washington, D.C.: Federal Reserve Bank of San Francisco and CFED, 2015, pp. 371–381, available at www.strongfinancialfuture.org/essays/toward-a-new-business-model/.