One measure of small business conditions is the findings of the 2015 Small Business Credit Survey (SBCS).1 The survey, which is a collaborative effort of the community development departments of the Federal Reserve Banks of New York, Atlanta, Boston, Cleveland, Philadelphia, Richmond, and St. Louis, includes responses from small businesses operating in 26 states.2 This article summarizes highlights of the 2015 SBCS.

The SBCS is an annual, online survey that has been conducted since 2010 among small businesses with 500 or fewer employees.3 The survey is distributed by small business development centers, professional small business associations, and chambers of commerce. Since the sample is not random, the data are weighted by industry, age, and employment size so that the distribution of firms in the survey more closely matches the distribution of the small business population in the survey coverage area.

2015 SBCS

Results

The SBCS was completed by 3,459 businesses from September to November 2015. Seven main highlights from the survey are outlined here.

1. Profitability, revenues, and employment improved.

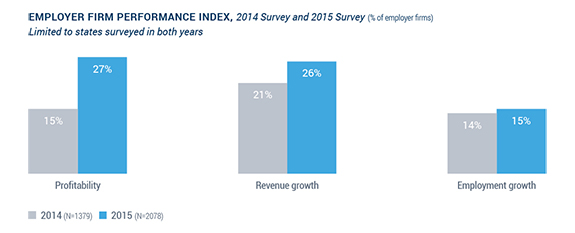

Business performance showed improvement from 2014 to 2015, as is reflected in profitability, revenues, and hiring. Respondents expected continued improvement in revenues and hiring in 2016 (Figure 1).

Figure 1. Employer firm performance index.

Source: 2015 Small Business Credit Survey: Report on Employer Firms, Federal Reserve Banks of New York, Atlanta, Boston, Cleveland, Philadelphia, Richmond, and St. Louis, March 2016

2. Financing outcomes improved.

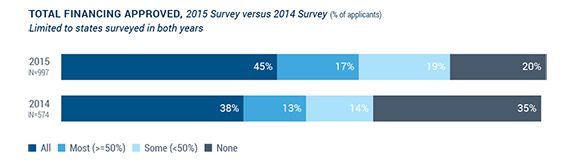

The number of small businesses that reported receiving all of the financing for which they applied rose from roughly 38 percent in 2014 to 45 percent in 2015. Likewise, the number of small businesses that received none of the financing for which they applied fell from 35 percent in 2014 to 20 percent in 2015 (Figure 2). The main intended uses of the financing were, first, expanding operations and, second, meeting operating expenses.

Figure 2. Total financing approved.

Source: 2015 Small Business Credit Survey: Report on Employer Firms, Federal Reserve Banks of New York, Atlanta, Boston, Cleveland, Philadelphia, Richmond, and St. Louis, March 2016

3. Customer satisfaction was highest with small banks.

Claire Kramer Mills, assistant vice president in the Communications and Outreach Group of the Federal Reserve Bank of New York, noted that small banks4 ranked highest among lenders in borrower satisfaction.5 In the 2015 SBCS results, credit unions, large banks, and online lenders were ranked second, third, and fourth, respectively, in borrower satisfaction.

4. Relationship with the lender was the most important factor in application decision.

The results of the 2015 survey indicate that the most important factors affecting the decision to apply for credit were, first, the relationship with the lender and, second, the cost of funding.

5. Personal assets were the most common type of collateral.

Personal assets were the most common collateral pledged to secure credit, regardless of the age of the business. In other words, similar percentages of businesses of all ages used personal assets to secure debt.

6. Small businesses are interested in obtaining financing from online lenders.6

Kramer Mills said that a consistent finding in the yearly surveys is interest in online lenders. In 2015, roughly 20 percent of survey respondents applied for credit through online lenders.

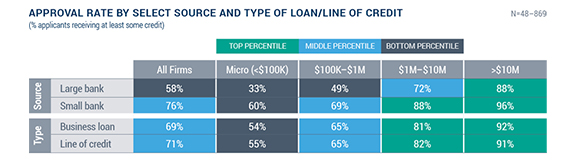

7. Approval rates for credit applications were highest from small banks.

The majority of applicant firms sought traditional loans or lines of credit from banks. However, approval rates were much higher from small banks than from large banks (Figure 3). This approval pattern held across all revenue sizes of firms. Overall, microbusinesses and firms with $100,000 to $1 million in annual revenues were much less likely to be approved by both small banks and large banks than their larger counterparts.

Figure 3. Approval rates by select source and type of loan or line of credit for both large banks and small banks. Small banks are defined as community or smaller regional banks. Large banks are defined as national or larger regional banks.

Source: 2015 Small Business Credit Survey: Report on Employer Firms, Federal Reserve Banks of New York, Atlanta, Boston, Cleveland, Philadelphia, Richmond, and St. Louis, March 2016

Conclusion

Overall, small business respondents to the 2015 SBCS survey reported positive trends in business performance and access to credit. Small banks played a vital role in providing credit to this market. Small businesses reported continued interest in online lending.

For more information, contact Claire Kramer Mills at claire.kramer@ny.frb.org or visit the Federal Reserve Bank of New York’s web page on the topic of small businesses at www.newyorkfed.org/smallbusiness.

The views expressed here do not necessarily represent the views of the Federal Reserve Bank of Philadelphia or the Federal Reserve System.

[1]2015 Small Business Credit Survey: Report on Employer Firms, Federal Reserve Banks of New York, Atlanta, Boston, Cleveland, Philadelphia, Richmond, and St. Louis, March 2016, available at www.newyorkfed.org/medialibrary/media/smallbusiness/2015/Report-SBCS-2015.pdf.

[2]About 7 percent of respondents were located in Pennsylvania and New Jersey. There were no respondents in Delaware.

[3]The businesses reported on here had at least one paid employee and no more than 500 paid employees. There will be a separate report released later this year on firms that have no paid employees.

[4]Small banks are defined as community or smaller regional banks. Large banks are defined as national or larger regional banks.

[5]Only successful applicants were asked this question in order to factor out any negative experiences stemming from a denied application.

[6]The SBCS questionnaire describes online lenders as nonbank online lenders, including alternative and marketplace lenders.