- Note: This brief has been updated since its initial release to reflect a change in the Small Business Credit Survey 2020 weighting scheme, which now more accurately reflects methods used in prior vintages of the data set. For more information, please reference the data appendix for the SBCS 2021 Report on Employer Firms at www.fedsmallbusiness.org/survey.

The Small Business Credit Survey is a national sample of small businesses, or firms with fewer than 500 employees, aimed at providing insight into firms' financing and debt needs and experiences. Analysis of this data set is issued through a series of reports.

This brief summarizes small business conditions in Pennsylvania between 2019 and 2020 using Small Business Credit Survey: 2021 Report on Employer Firms data. Three key topics are explored.

- Employer firm performance and challenges

- Information about emergency funding

- Expected challenges in the next 12 months

Impact of COVID-19 on Small Businesses

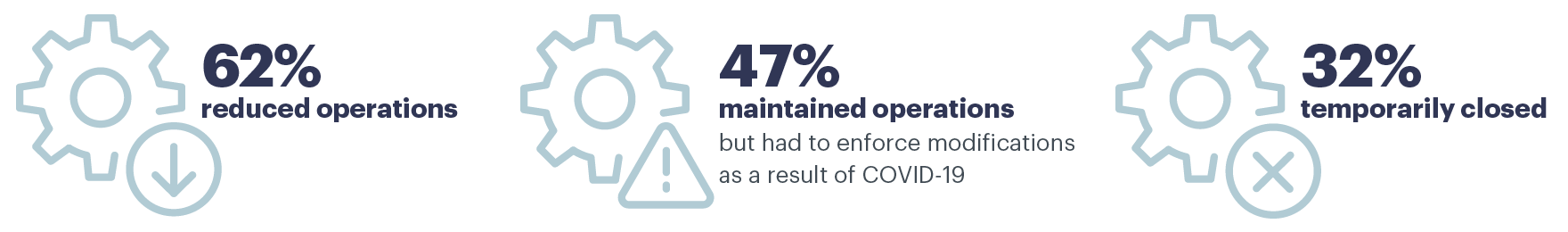

Pennsylvania small businesses experienced changes in revenue due to policies implemented as a result of COVID-19. Because of government mandates, some businesses had to close, reduce operations, or maintain operations with modifications, whereas others did not face a significant impact or were able to expand operations. Of the 637 small businesses that responded, approximately:

Similar analysis was conducted for New Jersey and the Third District.

View the Full Brief