Mills and Brayden McCarthy are the authors of “The State of Small Business Lending: Credit Access During the Recovery and How Technology May Change the Game,” a working paper published in July 2014 by HBS.1 The paper analyzes cyclical and structural problems in bank lending to small businesses as well as the growth of online small business lending. McCarthy is currently earning his M.B.A. at HBS and is also the head of policy and advocacy for Fundera, an online marketplace that connects small business owners with funding providers.

Keith Rolland recently asked Karen Mills several questions in a Cascade interview about online and bank small business lending trends. Her answers appear here.

- What are the strengths, limitations, and potential of online small business lending?

It’s important to first look at why it is that we worry about access to capital for small businesses.2 In the United States, there are more than 28 million small businesses — ranging from sole proprietorships to firms that employ workers producing goods or services in supply chains or serving customers on Main Street.3 Historically, small businesses have been responsible for nearly two-thirds of the net new jobs created in the United States. That rate, however, has declined since the recession, which took a significant toll on small businesses. Between 2007 and 2012, small businesses’ share of the total net job loss was about 60 percent. This impact is consistent with economic literature that tells us small businesses are always hit harder during a financial crisis because they are more dependent on bank capital to fund their growth.4

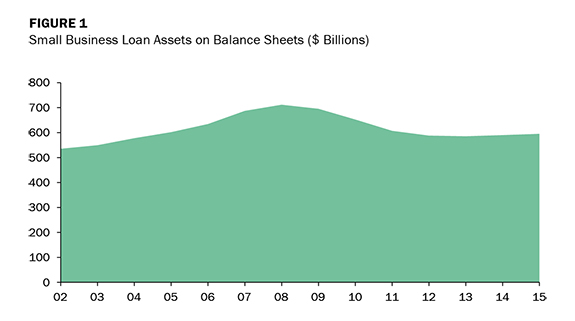

Bank credit is a vital lifeline for small businesses, and often ranks as high as equity from the business owner or friends and family. In fact, in 2012, more than 85 percent of small businesses reported to the National Federation of Independent Businesses (NFIB) that their primary financial institution was either a large or community bank.5 Yet, during and in the years following the financial crisis, bank loans to small businesses fell 18 percent and have only recently started to grow again (Figure 1).6

Figure 1. Bank loans to small businesses in the U.S. fell dramatically. Graph courtesy of Karen Mills.

Source: Federal Deposit Insurance Corporation, Call Report Data, as of January 2015.

With bank lending to small businesses slow to recover in the post-recession years, we saw a rise in the number of online lenders stepping into — or some would say disrupting — the small business market. These online lenders emerged along three models:

- Peer-to-Peer Marketplaces: Connect prime and subprime small business borrowers with capital from consumers and institutional investors that are looking for a return on their investment (e.g., Lending Club, Prosper);

- Borrower-Driven Broker Marketplaces: Connect borrowers with a range of traditional and alternative financing sources, ranging from banks and SBA-backed loans, to new online lenders (e.g., Fundera, Biz2Credit); and

- Balance Sheet Lenders: Leverage capital they hold on their own balance sheet provided by institutional investors to make loan decisions based on proprietary risk-scoring algorithms that rely largely on cash flow data (e.g., Kabbage, OnDeck).

Strengths of these online lending platforms include the ease of use by small businesses and the quick turnaround on loan decisions. Innovative applications of technology have made it possible for these new entrants to small business lending to collect application information and make loan approval decisions, based on proprietary risk algorithms, more quickly than applicants typically experience at banks. Yet, while online lenders may have an edge when it comes to customer service, they don’t have the existing customer bases that banks do. As a result, online lenders commit significant resources to finding customers and building their loan portfolios.

This does not mean, however, that online lenders won’t continue to increase their share of the small business market. In fact, Morgan Stanley estimates that lending by online lenders to small businesses will grow from 3 percent of the market today to 16 percent ($47 billion) in 2020.7 As a result, the real winners will most likely be the small business owners. Online lending continues to transform how small business owners access capital as well as how banks approach the small business lending market. (The projected growth in online lending is shown in Figure 2.)

Figure 2. Online lending in the U.S. is growing rapidly. Graph courtesy of Karen Mills.

Source: Company data, Morgan Stanley research estimates.

- Can banks compete with online lenders for small business loans? What are banks’ competitive advantages? Is there collaboration in small business lending between banks and online lenders?

Yes, banks can compete simply because their portfolios already include their existing small business customers, and they have large amounts of data about those customers. Additionally, banks don’t have to raise high-cost capital to compete because of their ability to make loans against their depository assets. Meanwhile, online lenders are devoting significant resources, in the form of investor dollars, to finding small business customers. This is the very reason why there is an opportunity for collaborations between banks and online lenders, and we are starting to see those partnerships form. Notably, JPMorgan Chase & Co., one of the nation’s largest banks, is partnering with OnDeck, one of the early entrants to the online lending market, to offer loans to its approximately 4 million small business customers through the online lender’s platform.8 In fact, banks are experimenting in a wide variety of ways with online lending, including everything from referring their smallest loans or loan declines to external online lenders, to participating in online marketplaces like Fundera and Lendio, to building their own in-house capabilities.

- How can both banks and online lenders better serve minority- and women-owned small businesses? Do either or both sectors currently have any initiatives targeted to such businesses?

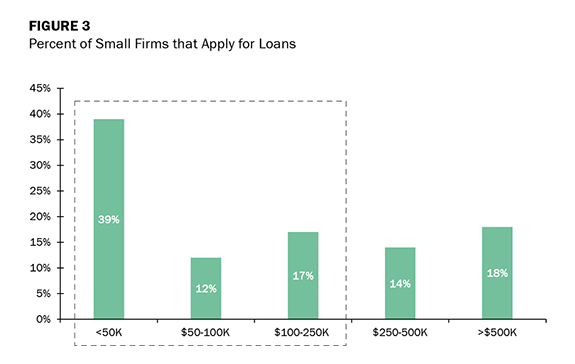

The persistent market gaps in small-dollar loans — the loans of $250,000 or less that are most needed by small businesses9 — disproportionately affect underserved segments of the small business community. This is why the SBA has launched a number of initiatives since the recession that are focused on small businesses in underserved communities. One such initiative is the current elimination of its fees on loans below $150,000.10 (See Figure 3 for survey findings about the importance of small loans.)

Figure 3. Firms want small loans, which aren’t profitable for banks. Graph courtesy of Karen Mills.

Source: Federal Reserve Bank of New York, "Small Business Credit Survey," Fall 2013.

Yet, a number of these market gaps and the reasons for them have not been fully identified. Nonetheless, it is possible that online lending may provide greater access for creditworthy borrowers in underserved areas — including among women-, veteran-, and minority-owned small businesses — by providing more transparent and accessible loan opportunities. In one example, Opportunity Fund, a nonprofit CDFI [community development financial institution] in California, formed a pilot program with the Lending Club to provide up to $10 million in loans to small businesses in underserved areas of California.11 We also have seen the emergence of some online lenders that specifically target underserved sectors of the small business community. One such lender is StreetShares, which targets veteran-owned small businesses with its peer-to-peer, auction-based platform.12 Additionally, an interesting approach that is worth considering is using Community Reinvestment Act (CRA)–motivated funds to provide the opportunity for community lenders to partner with online lenders in developing algorithms and channeling creditworthy borrowers to these new lending platforms.

- How can the financial literacy and financial management skills of small business borrowers strengthen?

Financial literacy and financial management skills are critical. In recent years, there has been an expansion in the sources of capital available to small businesses. But far too often, small business owners don’t understand their cash flow cycles and when to borrow in order to have the greatest impact on the businesses’ growth. They understandably are focused on running their businesses and it’s often hard for them to know what loan product they need at a particular point in the business cycle, and what terms and rates they should take on that loan. In the past, small businesses often had local bank advisors who helped the businesses think about what their actual need might be. However, with the substantial decline in the number of community banks, those local resources are less available.

As we look at the landscape of small business lending today, the customer–product fit is critical. A small business needs to find a loan with the size, duration, and cost that matches the needs of the business and its cash flow. In the absence of the local bank advisor who had a long-term relationship with a small business owner, it will be interesting to see if the new online lenders — as well as the big banks — can provide the advice and service required to ensure that small business owners get the loans that are right for them.

- Do regulatory burdens currently have a negative impact on small business lending on the part of banks?

There are a couple of key considerations that will continue to drive the regulatory conversation: First, what is the right balance of regulation as it relates to large and small banks? Small banks don’t have the same level of resources as their large counterparts do. With the addition of new regulations and a new regulator, compliance time for small banks has increased.13 To keep capital flowing from these banks to small businesses, regulatory guidance that is clear and not conflicting or ambiguous is critical.

Second, what oversight of online lenders should be put into place? Some feel there is an urgency to curb risk and potential bad actors, while others caution that stepping in too soon could stifle the innovation that is expanding access to capital for small businesses. An important initial set of guidelines called the Small Business Borrowers’ Bill of Rights was suggested by a number of industry participants last summer.14 This may provide an important framework for regulatory thinking going forward.

- What are the challenges and opportunities of online small business lending for regulators and policymakers?

There’s an important conversation to be had around the regulatory approach. The United Kingdom, for example, offers an interesting model in the form of principles-based oversight in which investor and borrower protections are established and govern industry practices. In the United States, the situation is more complicated because it is unclear which regulator or regulators have authority over the online lenders.

In general, it will be important to provide protections to ensure that small business owners are not exploited by the high interest rates that some online lenders charge. A positive first step involves transparency so that small business are able to clearly understand the terms of the loan and any additional expenses and fees or arrangements a lender is offering in a clear and transparent way.

Further data collection on the small business market, as mandated in Section 1071 of the Dodd–Frank Wall Street Reform and Consumer Protection Act, also will go a long way to highlight the needs and activity in this critical sector. Section 1071 includes provisions for collecting data on loans to underserved segments of the small business market. The Consumer Financial Protection Bureau should make it a priority to implement these provisions.

Online lenders are disrupting the small business lending sector. Their innovative application of technology and data is making it possible for small businesses to access credit through a more streamlined application process and in much quicker timeframes. The questions around transparency and regulatory oversight are certainly ones that need to be asked. But no matter the outcome of those discussions, what is clear is that the real winners will be the small businesses owners themselves, who will continue to see a growth in the sources from which they can access capital and more streamlined processes for doing so.

The views expressed here do not necessarily represent the views of the Federal Reserve Bank of Philadelphia or the Federal Reserve System.

[1]Karen Gordon Mills and Brayden McCarthy, “The State of Small Business Lending: Credit Access During the Recovery and How Technology May Change the Game,” Working Paper 15-004, Harvard Business School, July 22, 2014, available at http://ow.ly/YZxEz.

[2]Small businesses are defined for purposes of this article as firms with fewer than 500 employees.

[3]U.S. Census Bureau.

[4]Randall S. Kroszner, Luc Laeven, and Daniela Klingebiel, “Banking crises, financial dependence, and growth,” Journal of Financial Economics, 84 (2007), pp. 187–228.

[5]NFIB Research Foundation, “Small Business, Credit Access, and a Lingering Recession,” January 2012, available at http://ow.ly/YZA05.

[6]FDIC Call Report data, as of January 2015.

[7]Morgan Stanley Research, “Global Marketplace Lending: Disruptive Innovation in Financials,” Blue Paper, May 19, 2015.

[8]Ben McLannahan, “JPMorgan Plans Lending Venture with OnDeck Capital,” Financial Times, December 1, 2015.

[9]Federal Reserve Bank of New York, “Small Business Credit Survey, Fall 2013,” 2013, available at www.newyorkfed.org/medialibrary/interactives/fall2013/fall2013/files/full-report.pdf.

[10]U.S. Small Business Administration. “7(a) Loan Amounts, Fees and Interest Rates,” available at www.sba.gov/content/7a-loan-amounts-fees-interest-rates.

[11]The partnership was developed as part of a Clinton Foundation initiative. See http://ow.ly/YZJhs.

[12]Samantha Hurst, “Peer-to-Peer Marketplace StreetShares Captures $200M for Veteran-Owned Small Businesses,” Crowdfund Insider, March 11, 2015, available at http://ow.ly/YZJAc.

[13]See Marshall Lux and Robert Greene, “The State and Fate of Community Banking,” M-RCBG Associate Working Paper Series 37, Harvard Kennedy School, February 9, 2015, available at https://www.hks.harvard.edu/centers/mrcbg/publications/awp/awp37, and Mills and McCarthy, 2014, available at http://ow.ly/YZxEz.

[14]See Small Business Borrowers’ Bill of Rights at www.responsiblebusinesslending.org/.