The “impact investing” field includes a few investors that are investing in businesses specifically to create jobs for unemployed and underemployed residents. These investors also provide ongoing assistance to owners of the businesses to create “good quality jobs,” which generally provide income above the minimum wage, health benefits, and training and opportunities for workers to move into positions with higher wages. Three investors that are at the forefront of making investments with the “intentionality” of creating good jobs are profiled in this article.

HCAP Partners

HCAP Partners (formerly Huntington Capital) is a for-profit firm based in San Diego, CA, that invests mezzanine debt2 and private equity in growing small and middle-market companies in the health care, technology, services, and manufacturing sectors in the Western U.S. The firm’s first fund was formed in 2000 as a Small Business Investment Corporation licensed by the U.S. Small Business Administration, with limited partners including the State of California pension funds, as well as insurance companies, foundations, family investors, and financial institutions. HCAP Partners currently manages more than $200 million in total assets in three funds and is currently investing from its third fund.3

The firm believes that small and middle-market companies are underserved by traditional sources of growth capital, such as banks, venture capital firms, and private equity firms, and that these companies have the greatest potential to create jobs and spur growth. HCAP Partners typically invests $2 million to $9 million in businesses that have management with experience, annual sales of $10 million to $75 million, and earnings of $1 million or more before interest, taxes, depreciation, and amortization.

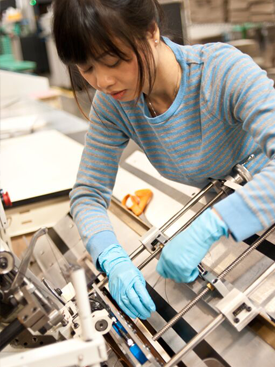

A worker uses equipment at RPI, a print manufacturer and fulfillment partner that received an investment from HCAP Partners. RPI, which has facilities in Seattle, Atlanta, and the Netherlands, is in the consumer print-on-demand personalized publishing market. It is certified as a sustainable green printing company.

Hope Mago, senior associate at HCAP Partners, said that the firm measures success first by financial return to investors and second by the number and kinds of jobs that its portfolio companies provide to employees and by ancillary “spillover” benefits, such as increased economic activity, job creation, and tax base growth in the communities in which the companies are located.

The company’s mezzanine capital, positioned between equity and senior debt, is structured as long-term loans with warrants to purchase stock or the right to receive royalty payments based on performance. These investments give HCAP Partners leverage with management and a seat on the portfolio companies’ boards of directors. HCAP Partners works with the leadership teams of its portfolio companies to enhance not only financial operations and performance but also job quality.

Mago said that HCAP Partners encourages companies to create jobs that pay living wages and provide paid sick days; health coverage, including preventive care; job training; advancement opportunities, including a “first look” at job openings for long-term employees; and opportunities for “broad-based participation,” such as stock ownership. HCAP Partners believes that an ownership interest leads to increased productivity and reduced turnover and allows companies to add wealth in the long run.

Mago explained, “We work with companies to develop a roadmap around implementing impact metrics that drive good quality jobs. For example, in some of our transactions we work with management officials to create a broad-based employee stock option program and help them embrace changes such as implementing comprehensive training programs, providing opportunities for advancement to low- and moderate-income (LMI) employees, and setting up a paid sick day program that can be instituted over time. We want the companies to own these practices so that they are sustainable past our investment period.”4

HCAP Partners measures impact on economic opportunity and health and wellness.5 Late in 2014, HCAP Partners developed a “floor-and-ladder” approach to help companies implement improvements in job quality standards concerning living wages, health benefits, and paid sick days. “The floor-and-ladder approach is used for all portfolio companies in Fund III as a tool to drive good quality jobs and better outcomes at the portfolio companies we invest in,” Mago said.

Floor-and-Ladder Approach

HCAP Partners developed tools to assist companies that received investments from its third fund to implement improvements in job quality standards concerning living wages, health benefits, paid sick days, opportunities for job advancement, and opportunities for broad-based worker ownership. The tools use a “floor-and-ladder” approach and were developed late in 2014 in collaboration with Transform Finance and Pi Investments. Download a PDF of the floor-and-ladder approach.

HCAP Partners produces annual reports on the impact of its investments. Mago explained that HCAP Partners originally monitored outputs (“what we do and who we reach”) and now focuses on outcomes (“what difference we have managed to make”) in economic opportunity, health care, and wealth creation.

Mago said the firm’s emphasis on impact intentionality instead of impact measurement has led to HCAP Partners’ recognition as a top impact fund manager.6 In June 2015, HCAP Partners explained the firm’s investing approach at an event of impact investors who plan to assist fund managers to adopt good job quality standards in their portfolios. The meeting, held at the Ford Foundation, involved Transform Finance,7 the Surdna Foundation,8 Pi Investments, and Ford.

HCAP Partners believes that a focus on quality job creation does not require the concession of financial return. Mago explained, “We believe that growth in a business’s revenue, income, and shareholder value are intertwined with impact intentionality, and we think a healthy, well-aligned workforce helps to drive value creation for employees, customers, and shareholders.”

As of June 30, 2015, HCAP Partners had invested in 57 small and medium-sized businesses, of which 49.4 percent are located in LMI communities, Mago said.9

Businesses that have received investments from HCAP Partners have increased the number of jobs they provide by 24.5 percent — or 1,510 jobs out of a combined workforce of 7,651 individuals, Mago said. The data are calculated from the time of HCAP Partners’ investment to either December 31, 2014, or the “exit” of its investment.

Inner City Advisors and Fund Good Jobs

Inner City Advisors (ICA), a nonprofit located in Oakland, CA, has provided entrepreneurial education, pro bono advising services, and hands-on assistance for the past 19 years to over 500 small businesses in the San Francisco–Oakland area. According to ICA, a good job is one that exceeds the minimum wage, offers full health and dental benefits, and provides opportunities for employees to move up in the company. Inner City Advisors (ICA), a nonprofit located in Oakland, CA, has provided entrepreneurial education, pro bono advising services, and hands-on assistance for the past 19 years to over 500 small businesses in the San Francisco–Oakland area. According to ICA, a good job is one that exceeds the minimum wage, offers full health and dental benefits, and provides opportunities for employees to move up in the company.

ICA helps companies define their staffing needs and recruit talent from hard-to-employ populations, such as ex-offenders, young people aging out of the foster care system, and people with limited education. ICA explained, “We partner with entrepreneurs who have both a solid business model and a commitment to creating a more equitable economy. We focus on the jobs they create and the individuals they hire. We assist companies in responsibly accessing capital and integrating good job creation in their growth plans from the start.”

Of 73 businesses it assisted in 2013, 59 percent were female owned and 48 percent were minority owned, according to ICA. In 2013, 66 percent of these businesses hired workers with employment barriers, it said.10

In 2013, ICA launched a nonprofit loan fund, Fund Good Jobs (FGJ), which uses program-related investments and recoverable grants to invest in growing small businesses that have the potential to create good jobs. Sean Murphy, managing director of FGJ and interim chief executive officer (CEO) of ICA, explained that, to combat widening inequality in the San Francisco-Oakland, CA, area, ICA and FGJ work with companies in fast-growing industries that offer significant employment opportunities with low educational barriers, such as restaurants, food manufacturers, and professional and technical services.11 Murphy added that there is a market gap in access to capital for growing companies that are seeking $150,000 to $2 million.

FGJ provides investments of $250,000 to $750,000 that are structured creatively to support companies of different sizes and capital needs. Companies can secure a lower interest rate on FGJ’s investments by meeting certain targets, such as hiring individuals who face barriers to employment, providing health benefits, or offering professional development opportunities. As an investor, FGJ works closely with the leadership teams of its portfolio companies, attending weekly team meetings and board meetings to provide hands-on support in managing cash flow and forecasting revenue.

FGJ has made four investments in the following San Francisco–Oakland, CA, companies, which are located in LMI neighborhoods:

- Back to the Roots, a specialty food manufacturer with lines of sustainable, organic products

- Impact Hub Oakland, a coworking space, business incubator, and event venue that encourages socially conscious entrepreneurship and job creation in Oakland

- Prather Ranch Meat Company, which works with independent ranches and farms to provide high-quality, sustainably raised meats

- Firebrand Artisan Breads, a bakery that produces small-batch, hand-shaped artisanal bread products

FGJ is pursuing certification as a community development financial institution and hopes that this will allow it to access capital from community banks and impact investors. Murphy observed that the integration of capital and support to small business owners is essential for the creation of good jobs.

Social Capital Partners

Bill Young founded Social Capital Partners (SCP), a national nonprofit based in Toronto, Canada, in 2001 following a successful career in the private sector. He funded SCP with some of the proceeds he received from the sale of two corporations, Hamilton Computers and Optel Communications Corporation, that he had managed as CEO. From its beginning, SCP has been focused on how meaningful job opportunities can be created for people who face employment barriers. The fact that SCP is self-funded has enabled it to make several “strategic pivots” in its work, Young said.

In its first phase from 2001 to 2007, SCP provided venture capital to six entities, comprising a combination of nonprofit and for-profit social enterprises, that employed disadvantaged, hard-to-employ residents. These enterprises included a property management firm in Vancouver that employed women who were victims of domestic violence, a housing renovation company in Winnipeg that employed Aboriginal Canadians, and a courier service in Quebec that hired young people from homeless shelters. Young said that the enterprises created several hundred jobs after five years, but “we [SCP] recognized that we needed to work with the private sector if we wanted to create significantly more jobs.”

In a second phase of its work, from 2007 to the present, SCP has focused on providing subordinated debt to more than 50 small business franchise owners in over 80 locations, with the purpose of motivating these businesses to provide employment opportunities for disadvantaged residents. Some of the franchises have been in the auto services industry, which Young described as attractive because of its low educational attainment requirements along with opportunities for upward mobility. SCP offers reduced interest rates to franchise owners committed to hiring a certain number of disadvantaged residents who have been screened and assisted by community-based nonprofit organizations. SCP and the nonprofits take responsibility for any problems with the new hires and find replacements if necessary, Young explained.

In the organization’s third and latest phase of work, SCP is looking for ways to make it simple and productive for employers to hire residents who have employment barriers. Young said that nonprofit and government efforts generally focus on the unemployed as the customer but that employers are just as important a customer. “Applying market-based solutions to systemic social issues is the key to sustainable impact,” he said.

SCP commissioned Deloitte to develop two reports that were released in 2014: one proposed a “demand-led” Canadian employment and training system with a strong focus on employers12; and a second focused on the feasibility of an Ontario-wide program that would encourage small businesses to employ low-income individuals.13 The second report, financially supported by the Ontario Ministry of Economic Development, Employment and Infrastructure (MEDEI), called for a pay-for-performance model that links payments with outcomes. The model would allow businesses to receive interest rate reductions for hiring low-income residents with employment barriers and retaining those employees for at least six months. In the model, loans would be provided by financial institutions that opt into the program, while funding for the interest rate reductions would come from the Ontario government, which could realize cost savings as low-income residents move from government assistance to stable employment.

Recently, the Ontario MEDEI announced a $4 million pilot known as the Ontario Community Loans Program. The program will give owners of small and medium-sized businesses discounted interest rates on financial products, such as loans, when they commit to hiring people who are faced with employment barriers, including people with disabilities. For loans, the interest rate will decrease for each person hired and retained for the required period. The ministry plans to work with Canadian banks, credit unions, and SCP to implement the pilot, which the ministry said was modeled on SCP’s work. The pilot aims to support up to 500 small businesses in creating up to 1,100 new employment opportunities.

Young observed that the program is an example of how social finance strategies can unite public, private, and nonprofit stakeholders by allowing risk, return, and impact to be allocated so that each party’s needs are met while delivering social outcomes that cannot be achieved by one party alone.

Conclusion

Firms such as HCAP Partners, FGJ, and SCP are leading examples of investors who are making investment decisions with the intention of creating good jobs for LMI residents, coupled with ongoing encouragement and assistance to business owners. In the process, impact investors are also seeking to demonstrate that improving employment opportunities will benefit a company’s productivity, retention, and morale and potentially result in increased financial return to investors.

For further information, contact Hope Mago at hope@hcapllc.com, Sean Murphy at sean@fundgoodjobs.com, and Bill Young at bill@socialcapitalpartners.ca.

The views expressed here do not necessarily represent the views of the Federal Reserve Bank of Philadelphia or the Federal Reserve System.

[1]The Global Impact Investing Network (GIIN), a nonprofit that strives to increase the scale and effectiveness of impact investing, defines impact investments as investments made to companies, organizations, and funds with the intention of generating measurable social and environmental impact along with a financial return.

[2]An explanation of mezzanine debt is available at http://www.hcapllc.com/investment-criteria/.

[3]Limited partners in HCAP Partners’ third fund include five banks and four foundations.

[4]Huntington Capital changed its name to HCAP Partners in July 2015 to highlight the firm’s partnerships with business owners and investors that seek to build profitable, socially responsible companies, noted Tim Bubnack, HCAP Partners managing partner.

[5]HCAP Partners’ impact reports are available at http://www.hcapllc.com/impact-investing/.

[6]Huntington is included in the report Impact Investing 2.0: The Way Forward — Insight from 12 Outstanding Funds, available at http://ow.ly/QkH5M. See also ImpactAssets 50, a list of 50 top impact investing fund managers, available at http://impactassets.org/ia50_new/.

[7]See http://www.transformfinance.org/.

[8]See http://www.surdna.org/.

[9]For an investment summary, see http://www.hcapllc.com/funds/. Examples of HCAP Partners’ portfolio companies are available at http://www.hcapllc.com/portfolio/.

[10]For further information, see Inner City Advisors’ 2013 Impact Report at http://2014.innercityadvisors.org/.

[11]Jose Corona, ICA’s founder and former CEO, left ICA in July 2015 to become director of equity and strategic partnerships for the City of Oakland, CA.

[12]The report is available at http://ow.ly/SCNKN.

[13]The report is available at http://ow.ly/SCOdM.